Operating system: Windows, Android, macOS

Group of programs: Business automation

Control of microloans

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

During business hours we usually respond within 1 minute

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

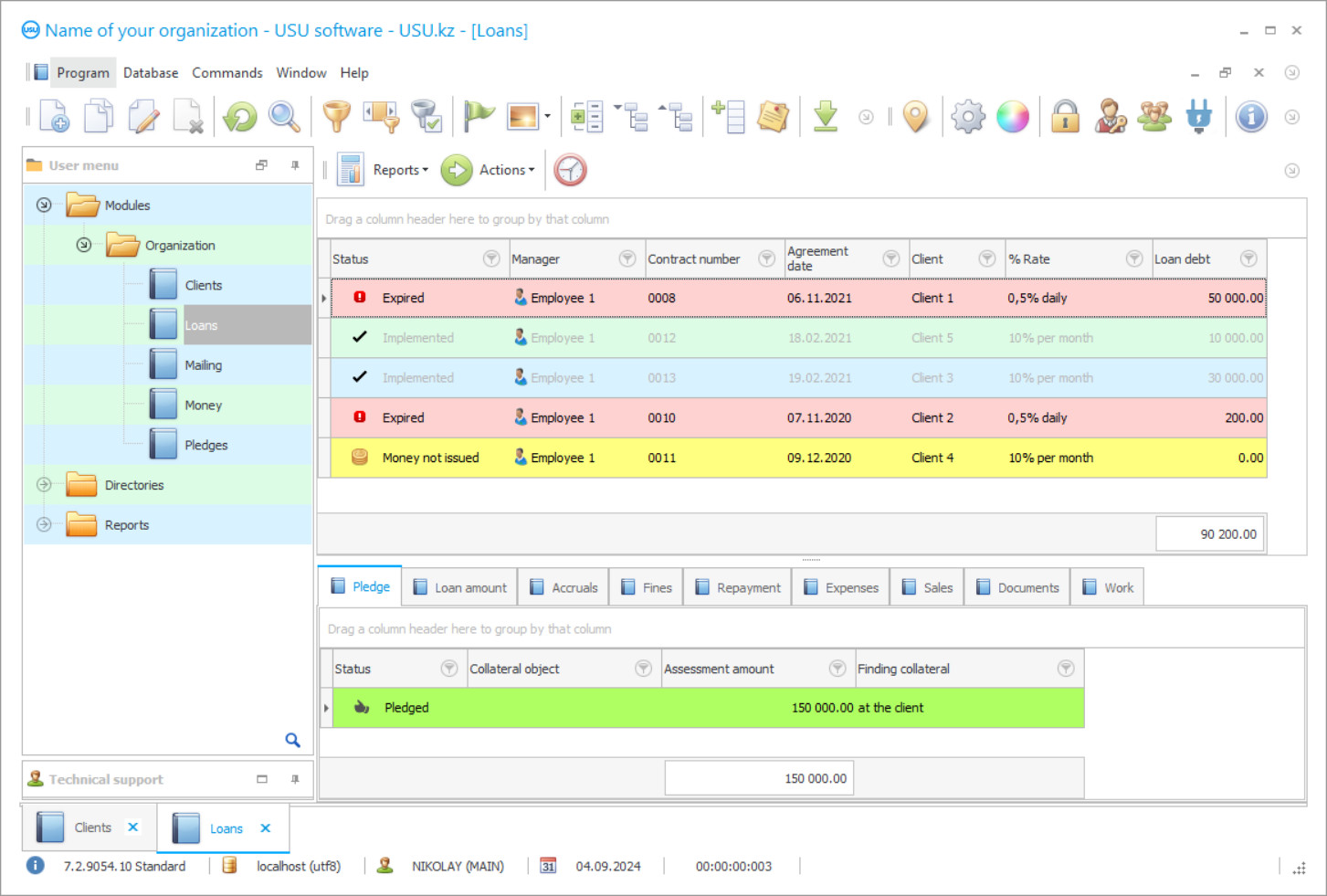

Program screenshot

A screenshot is a photo of the software running. From it you can immediately understand what a CRM system looks like. We have implemented a window interface with support for UX/UI design. This means that the user interface is based on years of user experience. Each action is located exactly where it is most convenient to perform it. Thanks to such a competent approach, your work productivity will be maximum. Click on the small image to open the screenshot in full size.

If you buy a USU CRM system with a configuration of at least “Standard”, you will have a choice of designs from more than fifty templates. Each user of the software will have the opportunity to choose the design of the program to suit their taste. Every day of work should bring joy!

Modern microloans companies are well aware of the advantages of automated supervision over microloans when it becomes possible to put in order the circulation of regulated documentation in a short time, build clear mechanisms for interaction with clients, and rationally allocate enterprise’s resources. Digital control of microloans is designed to optimize key levels of microloan control, where, due to an automation project, you can productively work with borrowers, exercise control over financial assets, and receive the latest analytical summaries on credit processes.

On the website of the USU Software, microloan optimization is presented by several software solutions at once, which were created with an eye on the operating standards. Digital control is characterized by efficiency, wide functionality, and reliability. However, the configuration is not considered complex. For ordinary users, a few practice sessions will be enough to manage the control program, determine the most comfortable ways to control, manage and organize the enterprise’s finances, learn how to manage microloans, and prepare all the necessary documentation.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-11-22

Video of control of microloans

It is no secret that the automation control of microloans makes it a primary task to reduce expenses and save brokers, managers, and accountants from a fair amount of unnecessary work. In particular, optimization of control concerns microloans and calculations of microloan rates. Through digital control, you can not only calculate interest on microloans, but also break down payments in detail for a given period, report to control, track financial assets in real-time, evaluate staff performance, and adjust current processes.

Do not forget that the automation of microloan control takes over the main channels of communication with borrowers, including e-mail, voice messages, digital messengers, and SMS. This is the easiest way to remind customers of payment deadlines or share promotional information. In-house specialists working with debtors will also face control optimization. The control program allows not only to promptly contact the borrower who is late for the next payment but also to automatically charge a penalty or apply other penalties.

Download demo version

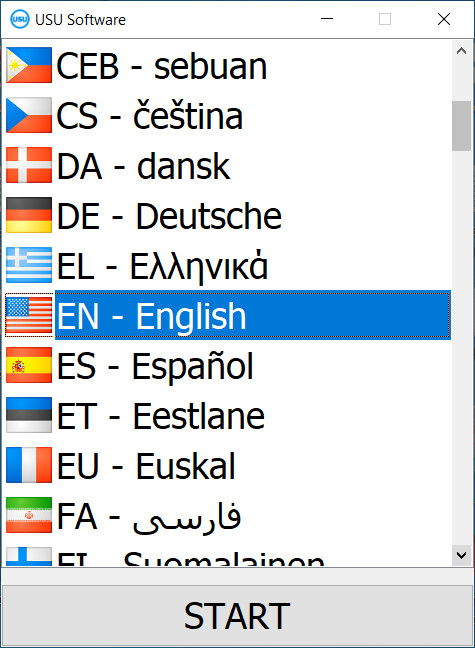

When starting the program, you can select the language.

You can download the demo version for free. And work in the program for two weeks. Some information has already been included there for clarity.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

The online configuration monitors the current exchange rate to instantly display the latest changes in the digital registers of the application and regulations. If microloans are directly related to the dynamics of the exchange rate, then the function is of key importance. The automation program carefully regulates the processes of microloan repayment, addition, and recalculation. With optimization, it will become much easier to work with collateral. For these purposes, a special interface has been implemented, where you can collect all the necessary information, give an assessment, designate the terms and conditions of the buyout.

In the field of microfinance organizations, many industry representatives are inclined to use automated control systems in order to most effectively manage microloans, prepare supporting documents, and have a wide range of optimization tools at hand. At the same time, special emphasis is placed on high-quality customer management where you can engage in targeted mailing, advertise services and improve the quality of work, as well as use external equipment, such as payment terminals, automatic telephone exchanges, and CCTV cameras, attract new customers and a lot more!

Order a control of microloans

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

Send details for the contract

We enter into an agreement with each client. The contract is your guarantee that you will receive exactly what you require. Therefore, first you need to send us the details of a legal entity or individual. This usually takes no more than 5 minutes

Make an advance payment

After sending you scanned copies of the contract and invoice for payment, an advance payment is required. Please note that before installing the CRM system, it is enough to pay not the full amount, but only a part. Various payment methods are supported. Approximately 15 minutes

The program will be installed

After this, a specific installation date and time will be agreed upon with you. This usually happens on the same or the next day after the paperwork is completed. Immediately after installing the CRM system, you can ask for training for your employee. If the program is purchased for 1 user, it will take no more than 1 hour

Enjoy the result

Enjoy the result endlessly :) What is especially pleasing is not only the quality with which the software has been developed to automate everyday work, but also the lack of dependency in the form of a monthly subscription fee. After all, you will only pay once for the program.

Buy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Control of microloans

The automation program regulates the main levels of control of a microfinance organization, including documentary support and distribution of financial assets. It is allowed to independently rebuild the parameters and characteristics of control in order to comfortably work with documents and a voluminous information base. For each operation with microloans, you can get comprehensive arrays of analytical or statistical information. Optimization makes it easier to take control of the main communication channels with borrowers, including e-mails, voice messages, SMS, and digital messengers.

Control over various software calculations allows users to quickly calculate interest on current microloans or break down payments in detail for a certain period. Information on microloans can be updated to add up to the current picture of financial performance and make adjustments if necessary. Optimization is structurally appropriate for both small microfinance institutions and microfinance giants. At the same time, the program does not put forward serious hardware requirements. The control program performs online monitoring of the current exchange rate to instantly display changes in system registers and regulations. On request, it is proposed to connect external equipment or install additional control options.

System control affects the processes of microloan repayment, addition, and recalculation. Each of them is displayed as extremely informative. The latest bulletins are easy to print. If the current financial indicators of microloans do not meet the plans of the control, there has been an outflow of funds, then the software intelligence warns management about this. In general, automation is set up to minimize the load, reduce costs, and streamline work and organizational issues. Optimization also applies to transactions with collateral finances. A special portion of the interface has been allocated for these material assets.