Operating system: Windows, Android, macOS

Group of programs: Business automation

System of the credit money

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

During business hours we usually respond within 1 minute

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

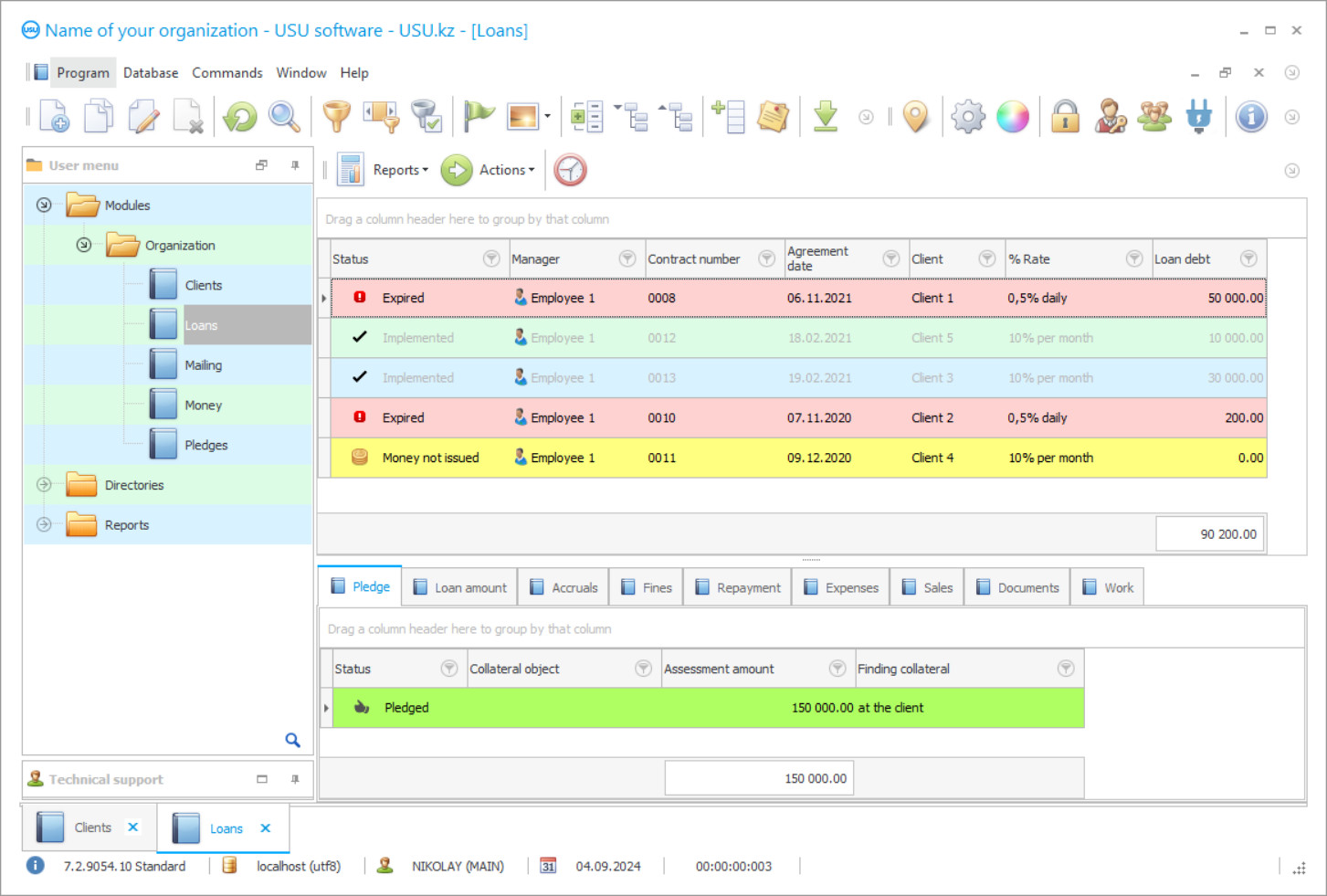

Program screenshot

A screenshot is a photo of the software running. From it you can immediately understand what a CRM system looks like. We have implemented a window interface with support for UX/UI design. This means that the user interface is based on years of user experience. Each action is located exactly where it is most convenient to perform it. Thanks to such a competent approach, your work productivity will be maximum. Click on the small image to open the screenshot in full size.

If you buy a USU CRM system with a configuration of at least “Standard”, you will have a choice of designs from more than fifty templates. Each user of the software will have the opportunity to choose the design of the program to suit their taste. Every day of work should bring joy!

The system of credit money is a part of the USU-Soft system and allows a credit institution to establish automated control over money - incoming and outgoing, i.e. as payments for credit repayment and in the form of issued credit. The difference in credit money includes interest rates, penalties, etc., so the system accepts credit money to conduct accounting, differentiating them by purpose, accounts, loan applications and borrowers themselves, and all these processes are automatic, relieving staff of many responsibilities. The only duty of employees in the credit money system is to timely record in electronic forms the performance of work operations and the results obtained, on the basis of which the system compiles a description of the current state of affairs in the credit institution.

According to the indicators presented in it, the management can objectively assess the real achievements and decide on the correction of lending activities. The state of affairs is even monitored remotely - the system of credit money is available with the presence of the Internet and, moreover, forms a single information network of all services and departments, branches, geographically remote from the head office. This functions with an Internet connection. The system of credit money distributes information across different databases, of which there are plenty. But they are all identical to each other in general form, not in content. This is convenient, since you do not need to rebuild each time when changing tasks. Information in the databases does not come directly from users, but only after sorting and processing by the system itself - it collects their readings from the forms filled in by users, sorts them according to their intended purpose, processes and already places the ready-made indicators in the corresponding databases available to other specialists.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-11-22

Video of the system of the credit money

The fact is that the system of credit money shares access to information, since different employees can work in it, not everyone needs to know about the state of credit relations. This is commercial information. Everyone has access to official data, but only within the framework of duties - exactly as much as is required for high-quality performance. Such division of access is provided by individual logins and passwords protecting them, each employee has a separate work area, where his or her personal electronic forms are collected to conduct accounting of finished work. They become personal at the time of filling, since they are marked with a login - the user opens it under his or her own name. Based on such forms, which list all the work for the period performed by each user, piecework wages are automatically calculated. This method of calculation provides the credit money system with the prompt addition of work results, which is what it needs to accurately describe the processes.

The contract and schedule are attached to the electronic application. The format allows a photo of the borrower to be attached, using a webcam from the employee's computer. At the same time, the credit money system even knows how to do image analysis, checking the identity of the borrower and his or her participation in other transactions with money. When placing an application, the manager fills out the form - the loan window, the client is selected from the CRM, where he or she must be registered, even if he or she receives a loan for the first time. To register a borrower, there is another electronic form. The system has a client window, where primary information is added - contacts, personal information, and a copy of an identity document. The manager can also ask the source of information from where the client learned that there it is possible to get money at interest, so that the credit money system later analyzes the sites that are used in promotion.

Download demo version

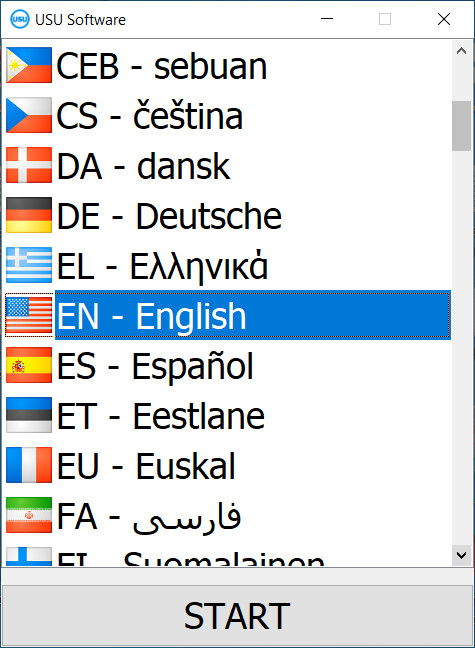

When starting the program, you can select the language.

You can download the demo version for free. And work in the program for two weeks. Some information has already been included there for clarity.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

As soon as the client is indicated in the loan window, the system requires the entry of data on the rate and period, and independently draws up a calendar for repayment of payments. After filling out the loan window, the manager receives a full package of documents accompanying the issuance of money, including an expense cash order, which it promptly prints for signature by both parties. At the same time, the cashier is being informed with a request to prepare a certain amount of money. There is an internal connection, which the credit money system supports in the format of pop-up windows - a notification instantly appears on the cashier's computer. As soon as the documents are signed, a confirmation of the readiness of the money is received from the cashier, the manager sends the client to the cashier. At the same time, the application in the loan database has one color. After receiving the money it will change to another - the application is confirmed, the money is issued. If the loan is repaid on time, then the current status of the application and the color for it will always be the same color, without attracting the attention of employees. If there is a delay in payment, the color (status) changes to red – this means a problem area.

The system actively uses color to indicate the state of performance indicators, which makes it possible to visually control the processes without detailing their content. The compilation of a list of debtors is accompanied by highlighting the size of the debt in color - the higher the amount, the brighter the cell of the borrower is. Other information, in fact, is not needed. Employees can jointly record in any documents - the multi-user interface eliminates any conflicts of saving data with a one-time access. Electronic communication is offered. It has the format Viber, e-mail, SMS, voice announcements, actively participates in the notification of clients, various mailings. Each borrower receives a timely reminder of an imminent payment, accrual of interest in case of delay, change in payment when the exchange rate jumps. The system automatically recalculates credit conditions when the exchange rate changes, if payments are received in local currency units, and the contract amount is specified differently. In addition to automatic notification according to the conditions specified in the database, the system offers promotion of services in the form of information and advertising mailings to all customers.

Order the system of the credit money

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

Send details for the contract

We enter into an agreement with each client. The contract is your guarantee that you will receive exactly what you require. Therefore, first you need to send us the details of a legal entity or individual. This usually takes no more than 5 minutes

Make an advance payment

After sending you scanned copies of the contract and invoice for payment, an advance payment is required. Please note that before installing the CRM system, it is enough to pay not the full amount, but only a part. Various payment methods are supported. Approximately 15 minutes

The program will be installed

After this, a specific installation date and time will be agreed upon with you. This usually happens on the same or the next day after the paperwork is completed. Immediately after installing the CRM system, you can ask for training for your employee. If the program is purchased for 1 user, it will take no more than 1 hour

Enjoy the result

Enjoy the result endlessly :) What is especially pleasing is not only the quality with which the software has been developed to automate everyday work, but also the lack of dependency in the form of a monthly subscription fee. After all, you will only pay once for the program.

Buy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

System of the credit money

Clients are divided into categories according to similar qualities, of which they form target groups to increase the efficiency of attraction and targeted appeal to a large number of them. In addition to the mailing report, a marketing summary is compiled, which provides an objective assessment of all marketing sites in terms of their productivity, taking into account investments and profits from them. The system also provides a report on services in the context of profit - which of them are popular, which are the most profitable. The system automatically performs any calculations, including the calculation of remuneration and the calculation of the cost of each loan and the profit from it, and compares the fact and the plan. The built-in industry-specific normative and reference database contains all regulations, orders, regulations, quality standards, which allows you to automatically normalize activities.

This database gives recommendations on keeping records, reporting forms, which is prepared by the automated system on time and in full, according to the requirements. The system has pre-nested text templates in organizing mailings, a spelling function, as well as templates of documents for various purposes to answer any request. The computer version uses the Windows operating system, but it has mobile apps on iOS and Android platforms that work for staff and borrowers.