Operating system: Windows, Android, macOS

Group of programs: Business automation

Program for finance and credits

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

During business hours we usually respond within 1 minute

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

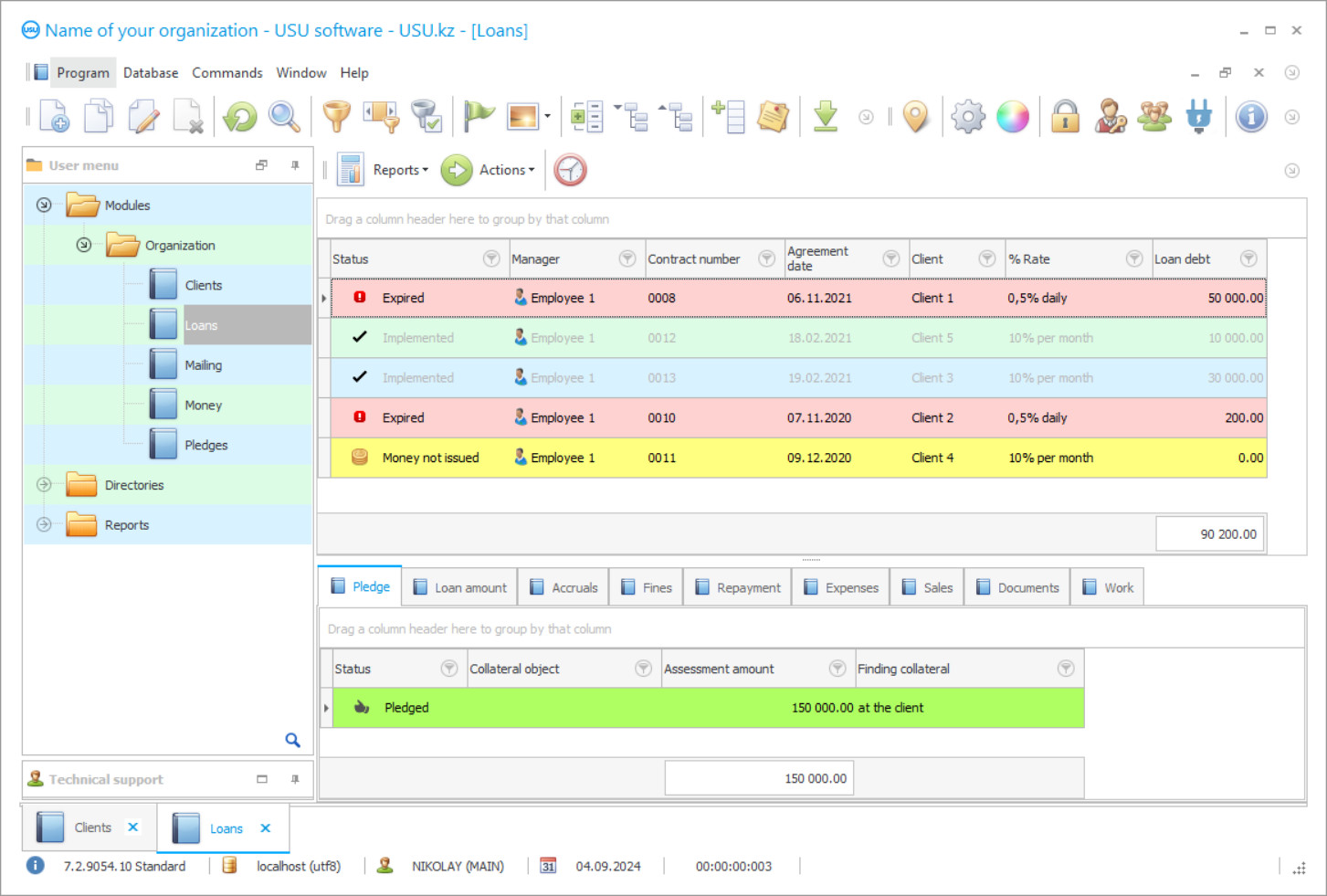

Program screenshot

A screenshot is a photo of the software running. From it you can immediately understand what a CRM system looks like. We have implemented a window interface with support for UX/UI design. This means that the user interface is based on years of user experience. Each action is located exactly where it is most convenient to perform it. Thanks to such a competent approach, your work productivity will be maximum. Click on the small image to open the screenshot in full size.

If you buy a USU CRM system with a configuration of at least “Standard”, you will have a choice of designs from more than fifty templates. Each user of the software will have the opportunity to choose the design of the program to suit their taste. Every day of work should bring joy!

The program for finance and credits is a configuration of the USU-Soft automation program of financial institutions management specializing in providing credits. The program of finance credits is universal and can be used by organizations with any level of finance and credits conditions. The program can be configured to be suitable in any organization. It is enough to enter its strategic data into the tuning block - assets, resources, work schedule and staffing table, indicate the presence of a branch network and advertising platforms for promoting services. This information is needed to organize the regulation of internal activities and accounting procedures, according to which there will be automatic distribution of finances that come from borrowers are provided in the form of credits. Automated control over finances will free up a lot of work time for staff, which they can spend on working with clients and attracting them to the organization's services.

The program of finance credits has a simple interface and easy navigation, which makes it possible for everyone to work in it, including those without computer skills and experience - the program of finance credits is mastered promptly after a master class, offered by the developer free of charge to novice users to demonstrate the work of functions and services that make up its functionality. Installation of the program of finance credits is also the developer's competence, as is the setting, while all work, including the master class, is done remotely via an Internet connection. The program of finance credits requires a Windows operating system as we are talking about the computer version. Mobile applications are also available and work on Android and iOS platforms, and in two versions - for staff and customers. It should be added that the program of finance credits can be easily integrated with the corporate website of the organization, which gives it the opportunity to conduct prompt updates on the range of services and personal accounts, where clients monitor the payment schedule and credit repayment. For convenient work with information on finance, several databases are formed. The most significant of them are the customer database, where "dossiers" are collected on them, and the credit database of registering credit applications.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-11-22

Video of the program for finance and credits

To work in the finance credits program, each user receives an individual login and a password that protects data and gives access to the information necessary to perform duties. This leads to the fact that the same document can be presented in different ways to different employees - within the framework of their competencies. All databases in the finance credits program have the same format - this is a list of participants and a tab bar of detailing the participant selected in the list. These tabs, which contain information on finance, may not be available in full to different employees - only those that are of interest to them. The cashier may have access to the tab with the payment schedule, but know nothing about the terms of the agreement, the details of which are presented in the next tab. The finance credits program separates access rights to protect the confidentiality of commercial and official information, which makes it possible to exclude the fact of postscripts, the appearance of inaccurate data, and protect finances from unauthorized write-offs.

The manager draws up an application for a new client in a special form - a loan window, indicating in it a minimum of information, including the loan amount and conditions - term, rate, monthly or daily interest. The client is not entered into the application – he or she is selected from the client database, where the link from the cell is given. This is the format of entering information in the program, which speeds up the procedure and allows you to establish internal connections between different values. They are a guarantee of the absence of false information. After filling in the window, the manager receives a full package of documents confirming the transaction - a completed agreement, an expense order, a repayment schedule. It is prepared by the program itself - this is its automatic "obligation", which includes all the documentation which the organization operates. The staff is completely exempt from the preparation of documents, current and reporting, as well as from accounting.

Download demo version

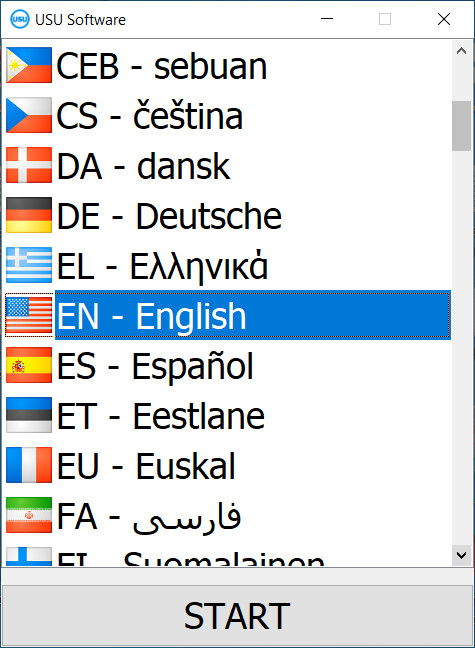

When starting the program, you can select the language.

You can download the demo version for free. And work in the program for two weeks. Some information has already been included there for clarity.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

In the process of filling out the information, the manager sends the cashier a task to prepare the amount of the loan to be issued and, when he or she receives a response about readiness, he or she sends the client with a ready expense order to the cashier. The client doesn’t even notice this communication - the program is efficient. The registration takes a few seconds, since everything is thought out by the program to the smallest detail. One of its tasks is to save working time, and various tools are used to solve it, including the unification of electronic forms (an example was a unified database format) and color indicators that allow you to visually observe the progress of work processes until problem areas appear here in red to attract attention. A late loan repayment is also a problem area. Such a client will be marked in red in all documents where he or she is mentioned - until he or she pays off the debt along with the accumulated interest.

The program offers more than 50 color-graphic interface design options, which makes it possible to personalize the workplace by selecting the needed one using the scroll wheel. At the end of each period, internal reporting is prepared with an analysis of all types of work, as well as an assessment of the activity of borrowers, the efficiency of employees, and the demand for financial services. A financial report allows you to objectively assess the growth rate of profit over time - it presents a diagram of its change for all previous and the past periods. All reports are provided in a form that is convenient for a study - diagrams, graphs and tables with visualization of the results obtained and their impact on the formation of profit. The financial report allows you to identify non-productive costs and exclude them in the new period, thereby saving on expenses, which affects the growth of financial results. The financial report allows you to find the deviation of the actual consumption indicators from the plan, determine the source of the problem, assess the feasibility of individual costs, and reduce them.

Order the program for finance and credits

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

Send details for the contract

We enter into an agreement with each client. The contract is your guarantee that you will receive exactly what you require. Therefore, first you need to send us the details of a legal entity or individual. This usually takes no more than 5 minutes

Make an advance payment

After sending you scanned copies of the contract and invoice for payment, an advance payment is required. Please note that before installing the CRM system, it is enough to pay not the full amount, but only a part. Various payment methods are supported. Approximately 15 minutes

The program will be installed

After this, a specific installation date and time will be agreed upon with you. This usually happens on the same or the next day after the paperwork is completed. Immediately after installing the CRM system, you can ask for training for your employee. If the program is purchased for 1 user, it will take no more than 1 hour

Enjoy the result

Enjoy the result endlessly :) What is especially pleasing is not only the quality with which the software has been developed to automate everyday work, but also the lack of dependency in the form of a monthly subscription fee. After all, you will only pay once for the program.

Buy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Program for finance and credits

The program has a multi-user interface which eliminates conflict when employees have a one-time access to documents to save the changes made. If the organization has a network of branches, their work is included in the general accounting due to the functioning of a single information space using the Internet. The automated system promptly responds to a request for current cash balances in each cash register, on a bank account, compiles a register of accounting entries, and calculates turnover. The system automatically makes any calculations, including the calculation of piecework wages, the calculation of the cost of services and loans, as well as the profit brought from each. To interact with borrowers, a customer database is formed. It has a CRM format. It stores the history of relationships, personal data and contacts, customer photos, and an agreement. In the CRM program, customers are divided into categories according to similar criteria, which the organization chooses to form target groups in order to increase the efficiency and accuracy of contacts.

The program offers employees to plan activities for a period, which is convenient to managers, since they can control employment, timing and quality of performance. There is a report on the difference between the actual volume of work at the end of the period and the one declared in the plan. It can be used to objectively evaluate and determine the effectiveness of each employee. The system works with mono-currency and multicurrency loans. When the loan is pegged to the exchange rate with repayment in local currency units, an automatic recalculation takes place.