Operating system: Windows, Android, macOS

Group of programs: Business automation

Automation of accounting in MFIs

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

During business hours we usually respond within 1 minute

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

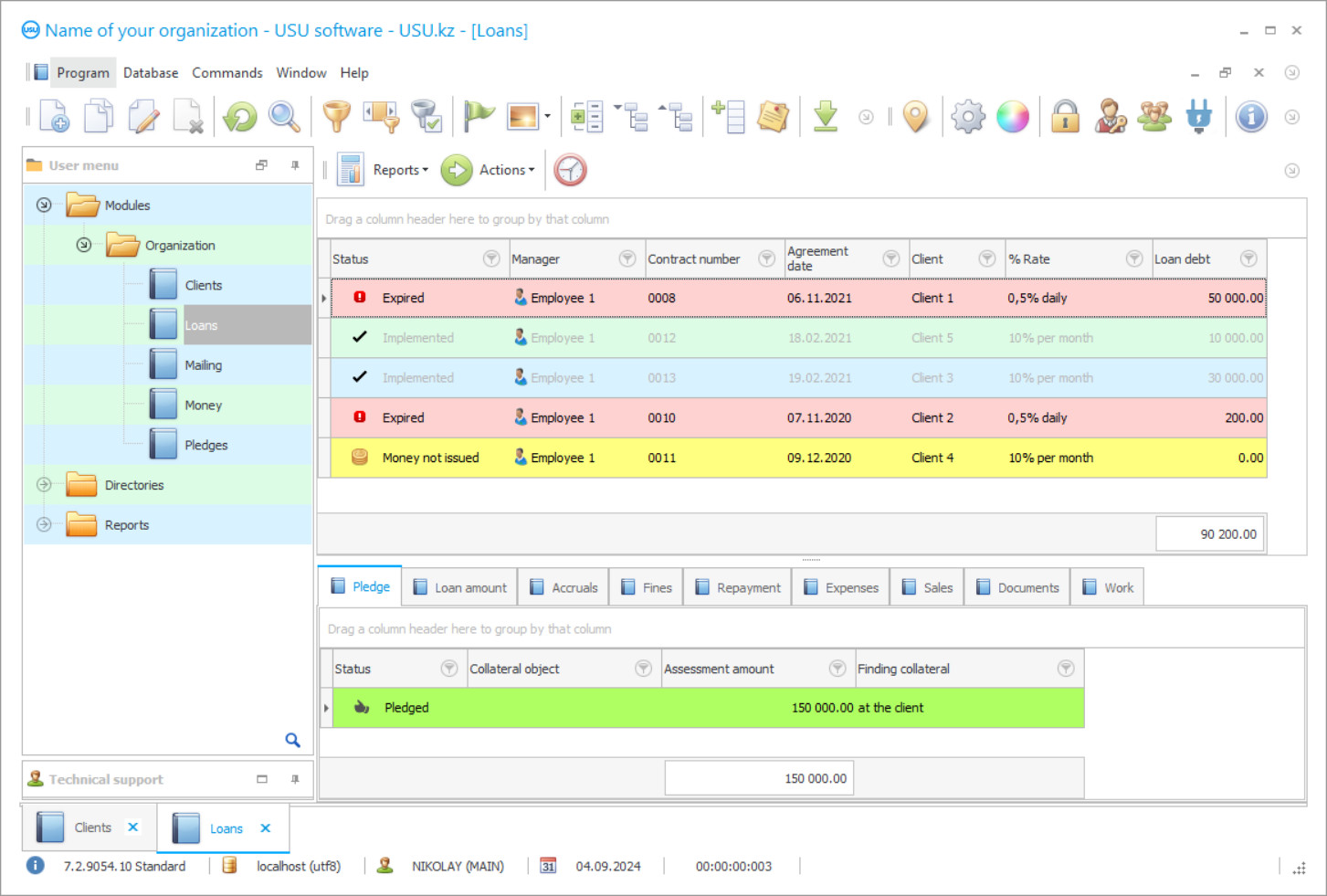

Program screenshot

A screenshot is a photo of the software running. From it you can immediately understand what a CRM system looks like. We have implemented a window interface with support for UX/UI design. This means that the user interface is based on years of user experience. Each action is located exactly where it is most convenient to perform it. Thanks to such a competent approach, your work productivity will be maximum. Click on the small image to open the screenshot in full size.

If you buy a USU CRM system with a configuration of at least “Standard”, you will have a choice of designs from more than fifty templates. Each user of the software will have the opportunity to choose the design of the program to suit their taste. Every day of work should bring joy!

Automation of accounting in microcredit institutions (MFIs for short) is very popular, since automation programs for MFIs not only support the financial accounting in small and medium-sized businesses, but are practically the only way to get accounting for a company that provides ordinary individuals who have been refused loans by banks or cannot wait for approval for a long time, but money is needed urgently. Clients of MFIs, as a rule, are people who are in dire need of additional funds, for example, for health treatment, and repair or replacement of household appliances. MFIs are also becoming a significant help for start-up entrepreneurs and large holdings, which, even with high-interest rates, turnover will allow them to make a profit. Loans help develop new areas of activity and receive dividends, giving them time to find additional funding. MFIs base their activities on the issuance of loans at a certain interest, up to a certain limit for a short period, but like any other activity, it needs quality accounting automation. Due to greater flexibility than the banking system, demand is growing, and as a result, the customer base. And the larger the business, the more acute the need to bring MFIs accounting to a single standard and automate it becomes.

But the choice of the optimal version of the accounting automation program is complicated by the wide variety presented on the Internet. When studying the reviews of other companies, you can determine the basic requirements, without which the application cannot be useful for the company. After analyzing a large amount of information received, according to reviews, you will probably conclude that the software, in addition to its functionality, should have a simple and understandable interface, without unnecessary problems, universal, with the ability to connect additional equipment and its cost should be within reasonable limits. It is also worthwhile to understand that automation programs for banks will not be suitable for MFIs, due to the specifics of the loan issuance processes. Therefore, it is important to pay attention to highly specialized accounting automation applications that will take into account all the nuances of such a business.

Our company develops software platforms with a narrow focus on the activities of each industry, but before starting to create a program, our highly qualified specialists thoroughly study all the nuances, focus on customer feedback and wishes before implementing the USU Software into customer’s MFIs. The application will establish full-fledged accounting in MFIs, and due to its simplicity and flexibility, this process will take very little time. Also, the transition to the automation mode will contribute to an increase in the speed and quality of service to borrowers, removing some routine tasks from the organization's employees. As a result of the implementation of the USU Software, in a short time, you will feel a significant increase in efficiency in the activities performed at your company.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-11-22

Video of automation of accounting in MFIs

The main work of the personnel will be to enter the primary data into the program since it is subsequently used automatically in the preparation of various documentation. The configuration of this accounting automation application allows you to configure the sending of messages to the client, via SMS, e-mail, or in the form of a voice call. In addition, we have provided for the possibility of creating mechanisms for making financial decisions, accounting for issued loans, integrating with messaging, third-party equipment, automatically generating reports based on existing templates, and immediately printing them by pressing a few keys. And this is not a complete list of the capabilities of our platform for accounting clients in MFIs. The program is distinguished by its simplicity and convenience in everyday use, users will be able to receive reports on the activities carried out at any time, which, judging by the feedback from customers, turned out to be a popular option. Sending information to the management will take a few seconds thanks to the well-thought-out interface. Automation will make it much faster to complete all processes, control and find information on clients.

The system has a function for recalculating the repayment amount, taking into account the state of affairs in the financial market. For high-quality and efficient internal data exchange, we have provided the possibility of pop-up messages, communication zones between employees. Thanks to this form of communication, the manager will be able to let the cashier know about the need to prepare a specific amount, in turn, the cashier will send a response about his readiness to accept the applicant. Thus, the time for completing a transaction will be reduced significantly, since the USU will automatically generate the entire documentation package. To ensure the effectiveness of accounting in MFIs, reviews will help in this, you can find them on our website. In addition, the automation program can process any amount of data, even the largest, without loss of speed, calculate the interest rate, set fines, penalties, adjust the timing of payments and notify about the delay.

To ensure greater order in the structure of interaction between clients and partners, we have worked out a mechanism for convenient management and a high level of information. But at the same time, the confidentiality of information is preserved, due to the delimitation of access to certain blocks, this function belongs only to the owner of the account, with the role main, as a rule, to the management of the organization. Our experts will take over all the processes associated with installation, implementation, and user training. All user actions will take place via the Internet — remotely. As a result, you will receive a ready-made complex for automating the business of accounting for MFIs in order to manage the entire structure more efficiently!

Download demo version

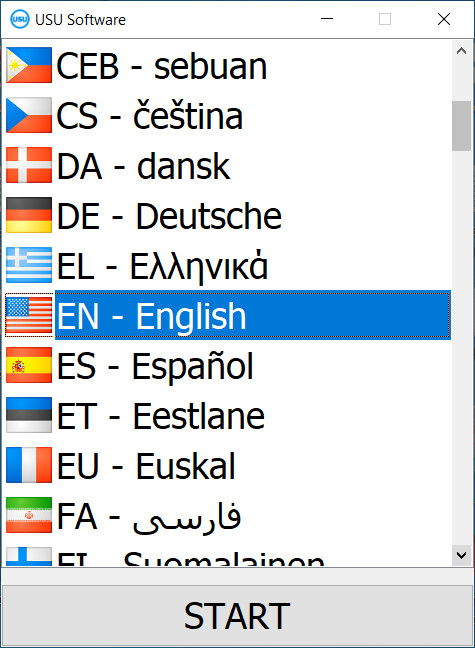

When starting the program, you can select the language.

You can download the demo version for free. And work in the program for two weeks. Some information has already been included there for clarity.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

The software configuration of the USU Software is a modular structure that has the required practicality and versatility. The system minimizes the chance of errors and shortcomings on the part of employees, as a result of the human factor (judging by the reviews, this factor is practically excluded).

USU Software is installed on any computers that the company has, there will be no need to invest in the purchase of new, expensive equipment.

Access to the automation program is possible either through a local network configured within one company or through an Internet connection, which will be useful if there are many branches. Accounting for clients in MFIs will become more structured, the reference database will contain a full range of data, scanned copies of documents on loan agreements. All assigned tasks will be completed much faster, due to a clear delineation of processes and a time frame. For accounting, the automation software will be a useful opportunity to receive the necessary data, financial reports, unload documents into third-party automation programs, using the export function.

Order an automation of accounting in MFIs

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

Send details for the contract

We enter into an agreement with each client. The contract is your guarantee that you will receive exactly what you require. Therefore, first you need to send us the details of a legal entity or individual. This usually takes no more than 5 minutes

Make an advance payment

After sending you scanned copies of the contract and invoice for payment, an advance payment is required. Please note that before installing the CRM system, it is enough to pay not the full amount, but only a part. Various payment methods are supported. Approximately 15 minutes

The program will be installed

After this, a specific installation date and time will be agreed upon with you. This usually happens on the same or the next day after the paperwork is completed. Immediately after installing the CRM system, you can ask for training for your employee. If the program is purchased for 1 user, it will take no more than 1 hour

Enjoy the result

Enjoy the result endlessly :) What is especially pleasing is not only the quality with which the software has been developed to automate everyday work, but also the lack of dependency in the form of a monthly subscription fee. After all, you will only pay once for the program.

Buy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Automation of accounting in MFIs

To ensure the effectiveness of the application of our system in microfinance organizations, we recommend that you read the reviews, which are available in large numbers on our website.

Accounting in MFIs involves automating the issuance of loans, negotiating contracts with clients, and preparing any required documentation. A well-built information base will help to quickly serve applicants, without unnecessary actions, in a short time. The call center function will help to establish fast interaction between all contractors, employees, potential borrowers. We develop software from the very beginning, which makes it possible to adapt to customer requirements by setting up the necessary functionality for a specific company.

At the first contact of the applicant, registration and the reason for the application is passed, which helps to track the history of interaction, and therefore reduce the likelihood of debt.

The mailing option will notify MFIs clients about profitable offers or the imminent maturity of the debt.

Accounting in MFIs (reviews of the USU Software application are presented in variety on our website) will become much easier, which is especially valuable for the management team. The software monitors the package of documents presented before obtaining a loan. In order to make it easier to decide on the choice of the necessary functions for accounting, we have created a test version, you can download it for free, using the link located below on our website!