Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting system in MFIs

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

During business hours we usually respond within 1 minute

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

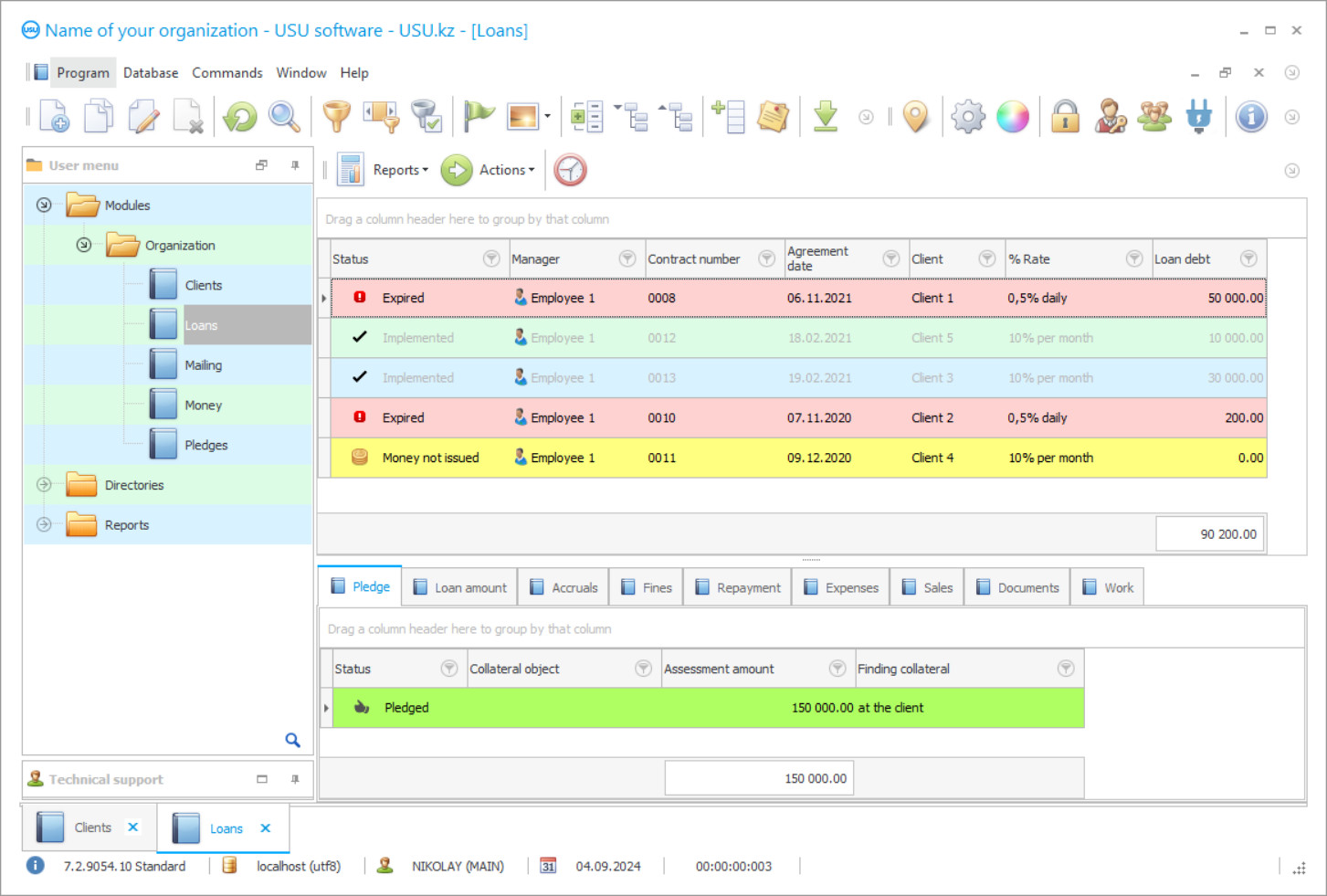

Program screenshot

A screenshot is a photo of the software running. From it you can immediately understand what a CRM system looks like. We have implemented a window interface with support for UX/UI design. This means that the user interface is based on years of user experience. Each action is located exactly where it is most convenient to perform it. Thanks to such a competent approach, your work productivity will be maximum. Click on the small image to open the screenshot in full size.

If you buy a USU CRM system with a configuration of at least “Standard”, you will have a choice of designs from more than fifty templates. Each user of the software will have the opportunity to choose the design of the program to suit their taste. Every day of work should bring joy!

MFIs include companies that carry out activities similar to the banking system, but smaller in scale and regulated by different norms and laws. As a rule, the amount of loans issued is limited, and clients can be both legal entities and individuals who, for whatever reason, could not use banking services. MFIs are able to issue funds promptly, with the provision of a small package of documents, differing in flexibility in maintaining contractual agreements. Today, the increased demand of such services is obvious, therefore, the number of companies providing such services is growing. But in order to be a competitive business, it is necessary to use modern technologies of accounting activities. The accounting system of MFI should be automated. This is the only way to be sure of the quality and relevance of the data received, which means that any management decisions can be made on time.

Among the popular software platforms, there is one that meets all criteria needed to ensure the accounting of MFI and this is the USU Software. It not only neutralizes the negative aspects of third-party resources but also provides maximum comfort in the process of work conducting. The application establishes accounting in MFI, significantly facilitate accounting, control the issuance of loans, take over the entire document flow, set up notifications for clients about new promotions and debt repayment dates. Often such MFIs should use several separate, disparate programs that do not have a single information field, but after the introduction of the USU Software, this issue will be resolved since we offer a comprehensive platform of automation. It keeps track of the deadlines for paying taxes by providing the necessary documentation, which is completed automatically.

We have created a convenient environment to maintain, store, and exchange data between organizational units and employees, which, judging by most reviews, is a key requirement for an automated system. Unified, centralized management of the MFI helps remote departments and mobile members of staff to have only up-to-date information, which will positively affect the performance associated with maintaining work commitments and achieving goals. USU Software designed to ensure an accounting in MFIs provides more opportunities to integrate with external applications that are used in everyday work. The system provides the availability of tools to support and subsequent configuration of any number of loan agreements, which is reflected in the reviews.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-11-22

Video of accounting system in MFIs

Work in the accounting system of the MFI begins with filling in the ‘References’ section. All information on the existing branches, employees, and clients is entered into the database. Algorithms for determining the solvency of applicants, calculating loan interest rates, mechanisms of calculating fines are also configured here. The more carefully this block is filled in, the more promptly and correctly all the work will be done. Main activities are carried out in the second section of the system – ‘Modules’, with separate folders. It is not difficult for employees to understand the purpose and apply it correctly the first time. For better accounting of MFI, the client base is thought out in such a way that each position contains a maximum of information, documents, and the previous history of interaction, which greatly simplifies the search for the required information. The third, last, but no less important section of the USU Software – ‘Reports’, which is indispensable in supporting the management since here you can get a general picture of affairs using up-to-date data, which means that you can only make productive decisions on business development of the MFI or redistribution of financial flows.

Our accounting system is able to conduct personalized control of loans to individuals, selecting the best options of collecting fines for late payment, automatically transferring penalties to the column of delinquencies when the accounting of MFIs occurs. The reviews, of which many are presented on our website, indicate that this option turned out to be very convenient. If the MFI applies collateral for loans in the form of collateral, then we will be able to control these resources by automatically attaching the appropriate documentation to the client card. All conditions have been created to prepare loan products, selecting the best ways to transfer funds to the borrower, and adjusting the conditions of already open agreements. In case of changes made, the software of the MFIs automatically creates a new schedule of payments, reflected in the new reporting.

Our specialists have taken care of creating conditions to ensure comfortable work not only locally but also in mobile mode when employees need to carry out activities outside the office. With all the wide functionality of the USU Software, it remains simple to conduct business and flexible in settings, as evidenced by the many positive reviews of our clients. In the system of accounting of MFIs, there is an option to set up posting templates, which allows you to apply any forms of predefined accounts. The use of pre-made templates helps to significantly reduce the time of the formation of documentation and the issuance of a loan. Also, employees will have at their disposal samples of forms for fines and a function of automatic numbering in the system of the MFIs.

Download demo version

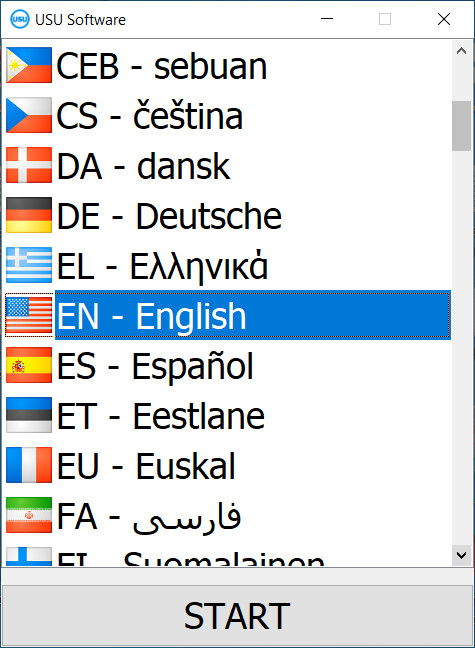

When starting the program, you can select the language.

You can download the demo version for free. And work in the program for two weeks. Some information has already been included there for clarity.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

The software system can adapt to the required document flow scheme in the loan issuing company. It is open for further expansion, administration, adaptation, which is much easier than in other accounting systems of MFIs. The ‘Reports’ section fully satisfies the needs of the directorate for analytical information. As a result of the implementation of our system, receive an effective tool that allows you to bring MFIs to a single standard and develop your business according to a clear strategy!

The accounting system is designed to facilitate the activities of MFIs in issuing loans, leading to the automation of all related processes, from the consideration of the application to the closure of the contract. Numerous reviews about our company allow you to be convinced of the reliability of cooperation with us and the quality of the developments we offer. The software of the MFIs forms a common information base that allows you to carry out productive work and receive only relevant data. In a common accounting database, it is possible to set up accounting of several organizations and branches, with different types of taxation and forms of ownership.

Self-correction of documentation templates helps to establish accounting of MFIs. Feedback on the USU Software allows you to decide on the final choice of the best option to ensure automation. The accounting system has a large number of tools to analyse the financial condition of the MFIs. Prompt formation of the entire set of documents, their storage, and printing are available. Each user is provided with a separate account of conducting work duties. Separate management of expenditures and profits within the framework of the goals, posting to the appropriate columns are also included in the system.

Order an accounting system in MFIs

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

Send details for the contract

We enter into an agreement with each client. The contract is your guarantee that you will receive exactly what you require. Therefore, first you need to send us the details of a legal entity or individual. This usually takes no more than 5 minutes

Make an advance payment

After sending you scanned copies of the contract and invoice for payment, an advance payment is required. Please note that before installing the CRM system, it is enough to pay not the full amount, but only a part. Various payment methods are supported. Approximately 15 minutes

The program will be installed

After this, a specific installation date and time will be agreed upon with you. This usually happens on the same or the next day after the paperwork is completed. Immediately after installing the CRM system, you can ask for training for your employee. If the program is purchased for 1 user, it will take no more than 1 hour

Enjoy the result

Enjoy the result endlessly :) What is especially pleasing is not only the quality with which the software has been developed to automate everyday work, but also the lack of dependency in the form of a monthly subscription fee. After all, you will only pay once for the program.

Buy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting system in MFIs

All our clients, based on the results of software implementation, leave their feedback and impressions, after reading them, you can study the strengths of our configuration. Backing up data and reference databases take place at certain periods set by users. The MFI system makes the work of employees much more comfortable and easier as routine operations for filling out papers and settlements will go into automation mode. The accounting system of MFIs calculates interest rates, benefits, and fines. The application carries out a full recalculation of the new loan conditions from the moment the applicant applies, re-issuing the existing schedule.

The software allows to perform flexible business and lending processes for legal entities, individuals, small and medium-sized businesses. Track the work of staff, recording their every action, and regulate work tasks. Based on the reviews about our company, we conclude that the USU Software fully automates all processes at a high level. It is easy to use, due to the full customization to the customer and specific company requirements. Search, sorting, grouping, and filtering in the accounting system of MFIs are carried out quickly, due to a well-thought-out mechanism of finding information!