Operating system: Windows, Android, macOS

Group of programs: Business automation

Computer program for credit institutions

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

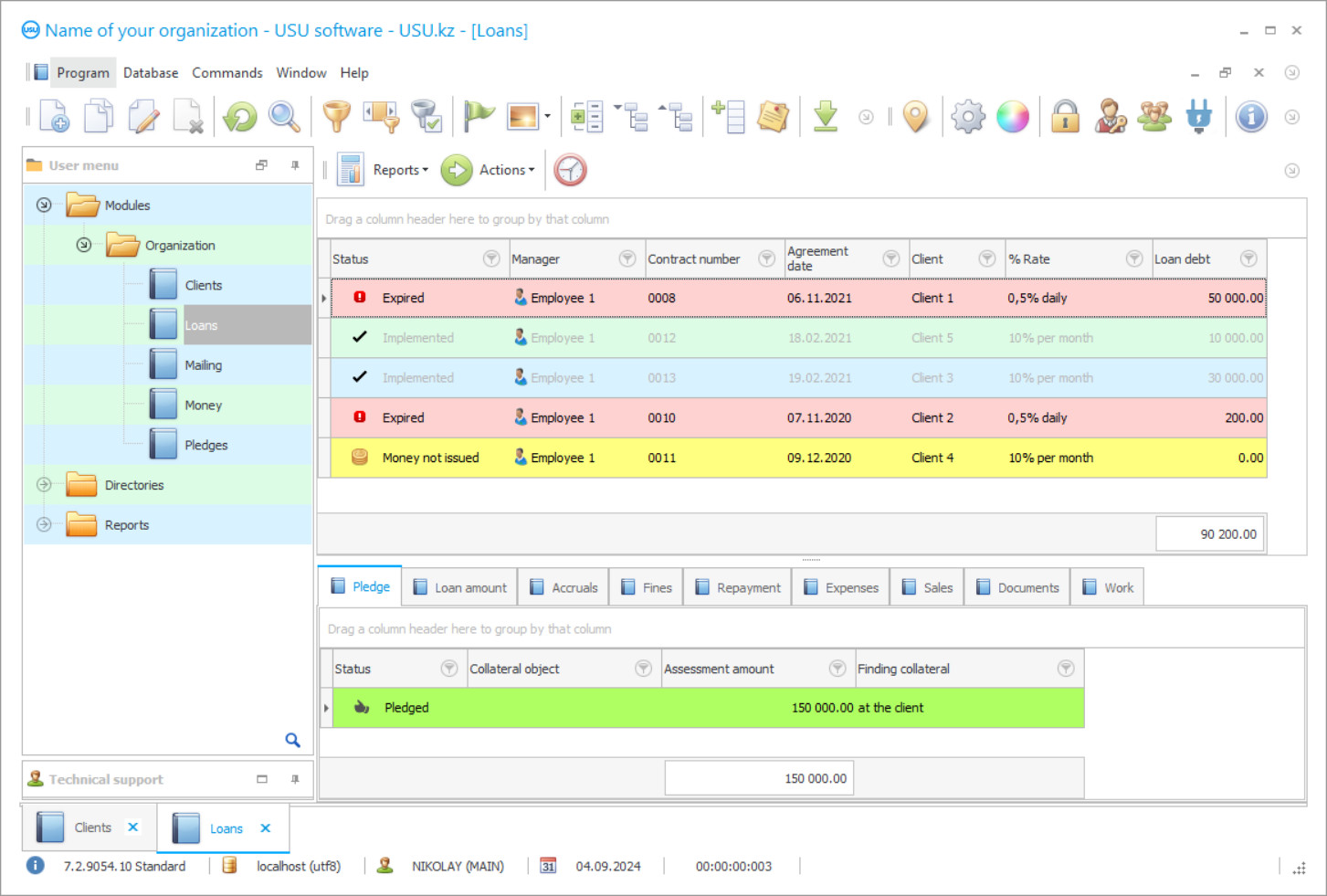

Program screenshot

The implementation of a computer program for credit institutions helps to maintain control of credit institutions at all levels and on an ongoing basis. These actions optimize the likelihood of risks and obtain more effective characteristics for the services provided, financial loans, in accordance with the established rules and regulations of the national bank of the country where the business is located. So that the business does not go bankrupt, monetary resources have a good turnover, commercial companies need constant monitoring of their movement. Starting from the moment a client receives a loan, MFIs or banks begin to track the funds and their condition. Such activities are designed to help in the proper provision of all operations for issuing loans, choosing the most secure option. But it should be understood that the guarantee of productive financial control is not only a well-established structure but also the creation of a single mechanism of activity between departments and employees in them.

Competent institution managers try to minimize manual labor. Automation helps to identify new opportunities for the effective use of the workforce, potential, and staff knowledge in the interests of the institution. Employees will be able to use the freed-up time to solve tasks requiring more qualifications. Computer programs are designed to reduce the number of shortcomings and errors that are directly related to the human error factor. Our institution specializes in the development of applications for the automation of various fields of activity, among our products, there is a control computer program for credit institutions. The USU Software can easily handle all the concluded contracts, received payments, will take over the maintenance of the register of customers, employees, monitor settlements, forming the necessary set of documentation and management reporting.

All information, documentation templates are entered in the ‘References’ section, here are set up algorithms for calculating and determining interest on loan agreements, a list of applicants is filled out, with attaching scanned copies of certificates. The USU Software provides for the separation of user access rights to their functions and information. And the multi-user mode allows you to maintain high productivity and speed of operations, while all employees work in the system simultaneously. In the accounting automation for credit institutions, you can carry out activities both on a local network and through an Internet connection. For each client of the credit institution, strict control of the availability of all required securities is carried out, the previous credit history is studied, which reduces the time for processing information and issuing approval or refusal. The terms for the provision of services are reduced several times. The computer program for credit institutions will bring work with clients to a qualitatively new level, notifying applicants in time about the onset of payments or the presence of arrears. The system allows you to configure the distribution of e-mails, SMS messages, or making voice calls.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-04-26

Video of computer program for credit institutions

This video can be viewed with subtitles in your own language.

All actions with credits will be under the control of credit institutions, which implies the responsibility of employees, therefore access and regulation possibilities are differentiated for each user. The flexibility of our computer program is regulated depending on the needs of the institution. But even after implementation and installation, our specialists will always be in touch and ready to answer any questions or provide technical support. For each license purchased, two hours of training are required, which is quite enough considering that the entire interface structure is built in an intuitive manner. The computer program will solve the issue of automating the issuance of credit loans, thereby reducing the time spent on processing requests, improving the quality of assessing the parameters of the client's solvency, practically eliminating the likelihood of fraudulent actions on the part of employees or visitors. Due to the presence of many options and forms for the implementation of work by institutions, the computer program is easy to customize for various specific needs. If there is a need to add new features, we can always make an upgrade at any stage of the computer program. Based on the numerous reviews of our customers, we conclude that the payback of the application occurs in a matter of months, the quantity and quality of the services provided for the previous period of time increases, the costs of accounting are noticeably reduced, and the workload on personnel decreases.

Risk control, created in accordance with the listed principles, will help credit companies improve the efficiency of the internal system, which will subsequently affect the greater stability of the dynamics, avoiding unpredictable leaps for which management is not ready. During the development of the control computer program for credit institutions, all the nuances of their activities, their positive experience, and requests for optimization were taken into account. As a result, the software platform has become a single quintessence of the best solutions for such forms of automation. After the implementation of USU Software, you will receive an optimal, versatile and comfortable system for business control!

The software keeps records of MFIs applicants, depending on their status and condition of the issued credit, registration, and a lot more.

Download demo version

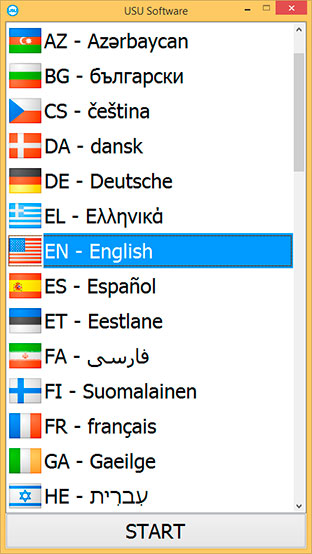

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

In the presence of several branches of the credit institution, a common information network is created, linking the entire institution into a single data exchange zone. The computer program generates plans for credit loans and calculates their parameters depending on the required parameters. If necessary, you can configure accounting and display information on guarantors, if such are provided by the institution's policy. If the loan requires collateral, then we will customize the application so that it composes the required package of documents, taking this factor into account.

The customer database involves storing and attaching scanned copies of papers, documentation required for the issuance of a loan. All prepared and almost automatically completed documentation can be printed directly from the computer program, with just a couple of keystrokes. At any time, you can adjust the existing templates or algorithms, for this you need to have access rights to the ‘References’ section.

The system will take care of all the nuances of issuing loans and controlling their repayment, while the type of currency can be adjusted. Each user will have his own area of responsibility and work, access to which only he and the manager will have. Payments with an interest rate can be calculated both manually and automatically. If necessary, all results can be exported to third-party applications that are applicable in the institution's daily work. The control of credit institutions by means of computer program configuration involves repayment of loans in strict accordance with the existing schedule, including other payments and penalties in case of delay.

Order a computer program for credit institutions

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Computer program for credit institutions

It is possible to configure the option of issuing certificates on completed payments for each borrower, based on the standards of this area. The USU Software provides for simultaneous work by several users, while there is no drop in the speed of operations performed. Managers will be able to quickly determine the current status of the loan; for this, a system of color differentiation has been thought out.

For the best safety of all databases and information, the function of backup and archiving was thought out, which allows you to restore it in case of equipment problems, from which no one is insured.

Thanks to the implementation of our USU Software, you will receive a unique computer program for comprehensive control of credit institution business processes!