Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting of credits and loans

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

During business hours we usually respond within 1 minute

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

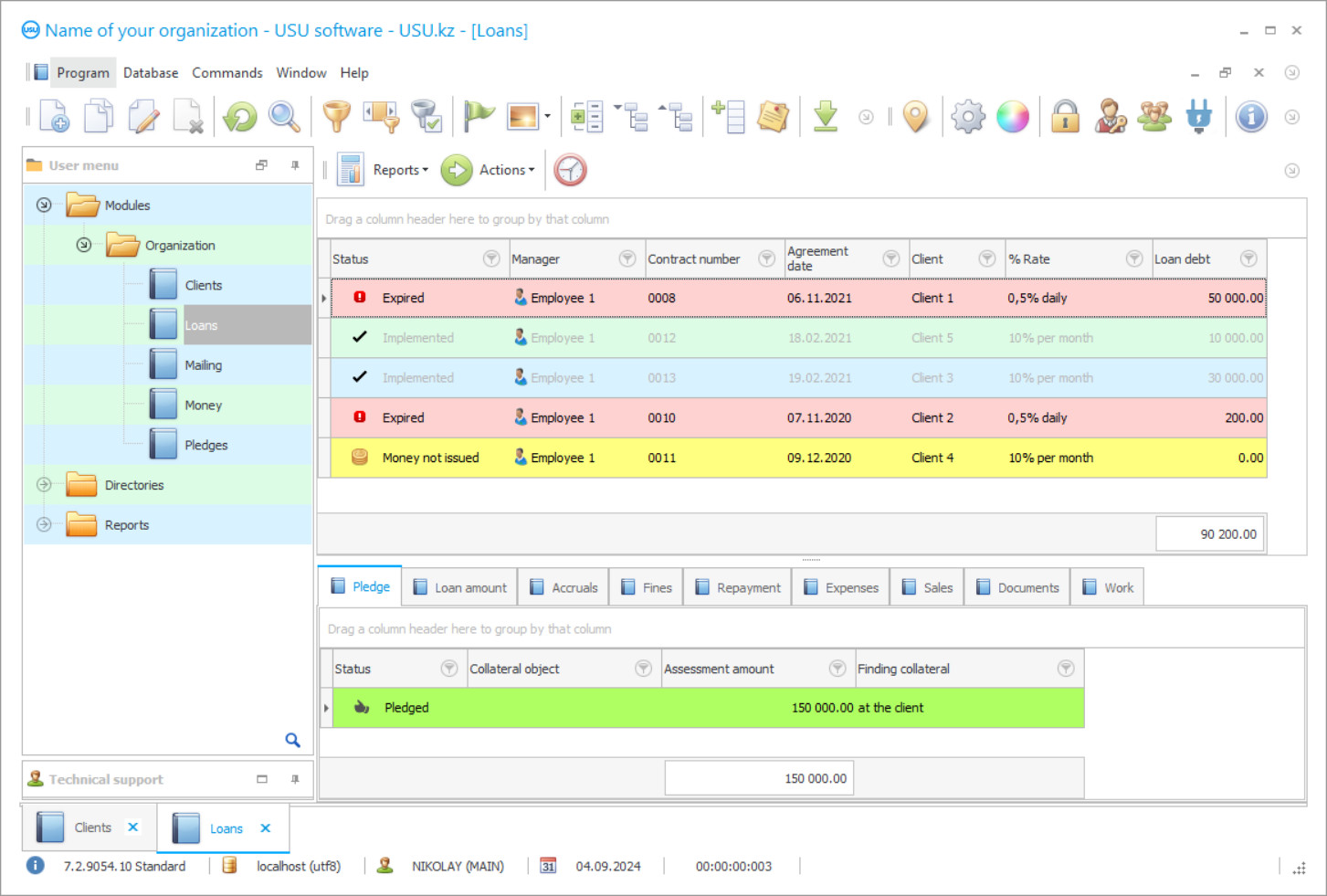

Program screenshot

A screenshot is a photo of the software running. From it you can immediately understand what a CRM system looks like. We have implemented a window interface with support for UX/UI design. This means that the user interface is based on years of user experience. Each action is located exactly where it is most convenient to perform it. Thanks to such a competent approach, your work productivity will be maximum. Click on the small image to open the screenshot in full size.

If you buy a USU CRM system with a configuration of at least “Standard”, you will have a choice of designs from more than fifty templates. Each user of the software will have the opportunity to choose the design of the program to suit their taste. Every day of work should bring joy!

In the economic market, the demand for credit organizations is growing, so their number is growing exponentially. Now you can find various companies that are ready to provide services for loans and credits. For quality work, you need to use a good program that can ensure the smooth operation of the company and increase staff productivity. Accounting of credits and loans in the electronic system helps to optimize the internal costs of the company.

USU Software considers the peculiarities of accounting of loans and credits, due to the built-in reference books and classifiers. It is ready to provide a large list of indicators for each industry. The high performance of this configuration ensures continuous ticket creation, even under high load. The interaction of all departments helps to form a single customer base. The peculiarity of this aspect lies in the fast processing of data and the actualization of information on-line.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-11-22

Video of accounting of credits and loans

Modern software controls the quality accounting of loans and credits. Reviews of this product can be read on the manufacturer's official website or on the support forum. When choosing a program, the company's management focuses on its relevance. Not many firms are ready to boast of a long track record of clients. Each review is supported by a specific feature example and user contact details.

In the accounting of a loan and credit, you need to take a responsible approach in the formation of records. All fields are filled in and, if necessary, a comment is added. To ensure the correct formation of reports, it is necessary to enter only reliable information. A feature of electronic filling is the mandatory indication of all required values. At the end of the reporting period, at the request of management, the indicators are sorted by type of loans and credits. This is necessary to maintain the correct distribution of duties and areas between personnel.

Download demo version

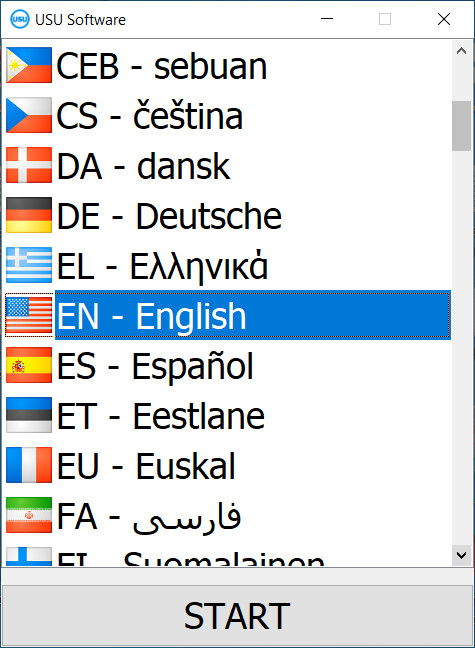

When starting the program, you can select the language.

You can download the demo version for free. And work in the program for two weeks. Some information has already been included there for clarity.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

Credit organizations, when choosing software, are guided by the availability of reviews. However, it should be noted that this is not always beneficial. Each firm has its characteristics and should rely on its own criteria. By using the trial version, you can evaluate all functions and determine the level of performance. If new ideas arise for changing the functionality, then it is worth writing a review to the company's technical department.

To support the accounting of loans and credits, the use of a special configuration involves the automated filling of documents, calculation of interest rates, and debt repayment schedules. Each application has its unique characteristics. Therefore, total control is needed since not only small amounts are issued, but also large ones. Each department has a leader who monitors the performance of ordinary employees. Liability is fixed on the generated applications. The log contains the user and the date of the operation. Through sorting and selection, the firm's management can identify innovators and leaders. This may affect the payment of additional rewards.

Order an accounting of credits and loans

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

Send details for the contract

We enter into an agreement with each client. The contract is your guarantee that you will receive exactly what you require. Therefore, first you need to send us the details of a legal entity or individual. This usually takes no more than 5 minutes

Make an advance payment

After sending you scanned copies of the contract and invoice for payment, an advance payment is required. Please note that before installing the CRM system, it is enough to pay not the full amount, but only a part. Various payment methods are supported. Approximately 15 minutes

The program will be installed

After this, a specific installation date and time will be agreed upon with you. This usually happens on the same or the next day after the paperwork is completed. Immediately after installing the CRM system, you can ask for training for your employee. If the program is purchased for 1 user, it will take no more than 1 hour

Enjoy the result

Enjoy the result endlessly :) What is especially pleasing is not only the quality with which the software has been developed to automate everyday work, but also the lack of dependency in the form of a monthly subscription fee. After all, you will only pay once for the program.

Buy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting of credits and loans

There are many other features of the accounting of credits and loans that you will find useful. One of the priorities is the security and privacy of the data entered into the credit system. To ensure that information will not be lost and prevent the ‘leak’ of important data, personal logins and passwords are provided, which restrict the area of work of every employee. They are divided into groups according to the positions and responsibilities of each worker, so there is no confusion. Moreover, the program of accounting can perform the distribution of job duties, according to the job description, which significantly saves time and labour sources. It is really beneficial for the credit enterprise as most of the effort will be directed to other essential operations, which considerably affects the performance of the whole working process.

Other facilities are the tracking of the performance of personnel's labour functions, interaction of departments, scheduled backup, timely update, access by login and password, transferring configuration from other software, implementation in any activity, unified customer base, contact details, unlimited creation of departments, timely component updates, uploading the information base to an electronic medium, revocation of documents, making changes promptly, creation of plans and schedules, control over the repayment of loans and credits, credit calculator, formation of an application via the Internet, accounting and tax reporting, convenient menu, help call, actual reference information, synthetic and analytical accounting, payment through payment terminals, identification of overdue contracts, determination of the amounts of monthly loan repayment, analysis of the current financial situation, monitoring indicators, document templates, operation log, service level assessment, salary and personnel records, cash flow control, interest calculation, working with currency, accounting of primary and secondary activities, travel documents, cash discipline, payment orders and claims, strict reporting tables, consolidation of reports, inventory management, book of reviews and suggestions, built-in assistant, setting the parameters of the features of work in a given industry, feedback, interaction of branches, special reference books and classifiers, partial and full repayment of debts, video surveillance service at the request of the company, continuity of accounting, book of income and expenses.