Operating system: Windows, Android, macOS

Group of programs: Business automation

Microloans accounting

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

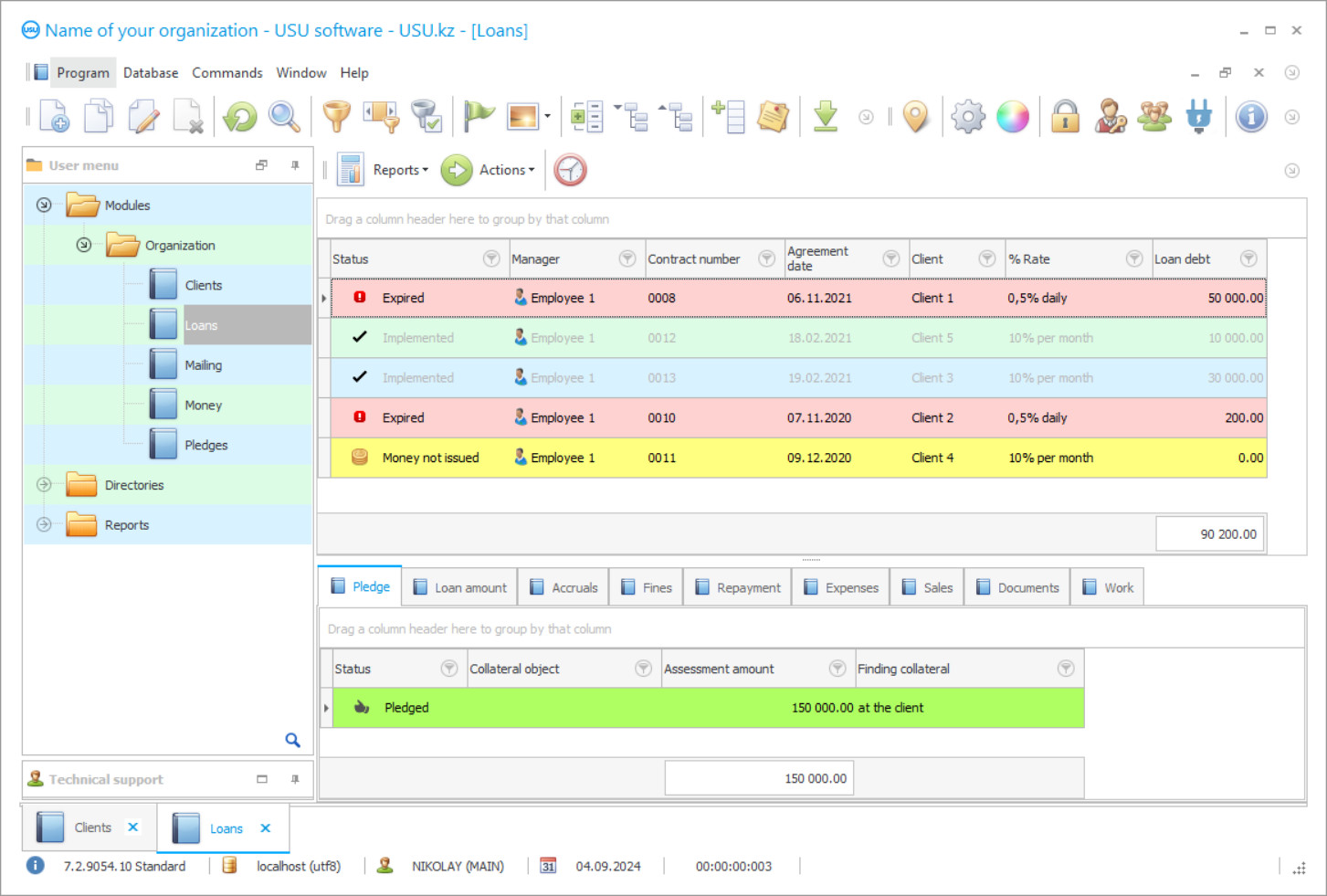

Program screenshot

In the field of microloans accounting, one can increasingly observe automation trends, which is easily explained by the desire of modern companies to put in order regulatory documents, build clear and understandable mechanisms for interacting with the client database, and promptly collect relevant analytical data. It is included in the basic range of support and digital accounting of settlements for short-term microloans, which allows the organization to work more substantively on computing operations, regulate financial assets and deal with operational accounting and preparation of accompanying documentation. On the website of the USU-Soft several promising software solutions have been developed at once for the standards and nuances of microfinance, including the organization of accounting of settlements on short-term microloan. The software is reliable, efficient and trustworthy. At the same time, the project cannot be called complicated. Directly in practice, you can deal with operational accounting, learn how to make calculations, detail payments for a given period of time, register new microloan applications, issue pledges, and work with the organization's regulations.

Who is the developer?

2024-04-17

Video of the microloans accounting

This video can be viewed with subtitles in your own language.

It is no secret that automatic calculations are of key importance in the daily work of a microfinance organization. Users have no problem calculating interest on microloans, real-time tracking of short-term payments, printing standard forms and accounting forms. A separate emphasis is placed on penalties in relation to borrowers. If the client does not pay the bills and is late for the next payment, then it is possible not only to notify the subscriber with an information notification, but also automatically (according to the letter of the microloan agreement) charge a penalty. Do not forget that several users are able to work on calculations at the same time. If necessary, access rights can be privately adjusted to protect sensitive accounting information. For example, financial documents, personal data of clients, etc. In general, dealing with short-term payments and microloans will become much easier. The main channels of communication with borrowers are controlled by digital intelligence, including voice messages, SMS, Viber, E-mail. The organization will only have to choose the preferred method of targeted communication.

Download demo version

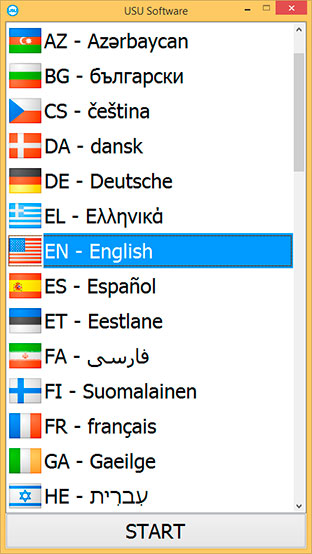

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

The accounting application also regulates as accurately as possible the positions of the collection, repayment and recalculation of the microloan in order to substantively work with short-term payments, monitor the fulfillment of the client's obligations to the microfinance organization, and control the movement of cash assets. Exchange rate calculations are carried out online. The system of microloans accounting instantly updates the registers, displays the new values of the exchange rate in the regulatory documents. Pledge acceptance and transfer acts, cash orders, microloan and pledge agreements are specified as templates. Users will only have to fill in the forms. There is nothing surprising in the fact that modern microloans institutions are striving to switch to automated accounting in order to automatically perform all the necessary calculations, put in order regulated documents, and work more productively with short-term financial transactions. Nevertheless, the main advantage of digital support lies in high-quality interaction with the customer database, when you can effectively influence debtors, attract new customers, gradually improve the quality of service and objectively strengthen your position in the financial market.

Order the microloans accounting

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Microloans accounting

The software assistant monitors key aspects of the microfinance organization's work, including documenting microloans and conducting information support. The accounting system of microloans management parameters can be set independently in order to substantively work with accounting categories and regulatory documents to monitor the performance of personnel. Credit interest calculations are fully automated, which guarantees both promptness and accuracy of calculations. Short-term microloans are displayed in a visual form, which allows you to make adjustments on time, detect weak positions, and make management decisions. Accounting of key communication channels with borrowers includes voice messages, Viber, E-mail and SMS. It will not be difficult for users to master the targeted mailing tools. Several users can work on calculations at once. Access rights to information (and operations) can be restricted.

It provides for the maintenance of a digital archive, where you can raise statistical information on short-term microloans, operations or clients, study analytical calculations and documents. The good faith fulfillment by the borrower of its microloan obligations is regulated especially carefully. Otherwise, the configuration automatically applies penalties. You should not exclude the possibility of synchronizing software with payment terminals, which will significantly improve the quality of service. Accounting of the current exchange rate is included in the basic spectrum of the program of microloans accounting. It monitors the exchange rate online to instantly display the slightest changes in registers and documentation. If the current indicators on short-term loans do not meet the requests of the management, there has been a drop in profits and a churn of the client database, then the software intelligence will warn about this. In general, it becomes much easier to manage loans when an automated assistant controls every step.

The system of microloans accounting regulates not only settlements, but also positions of financial repayment and recalculation. Each of these processes is displayed very informatively. The release of the original turnkey application opens up completely different possibilities for the customer. One has only to make adjustments to the design and install new functional extensions. It is worth checking the performance of the working demo in practice. It is available free of charge.