Operating system: Windows, Android, macOS

Group of programs: Business automation

Management in a financial and credit organization

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

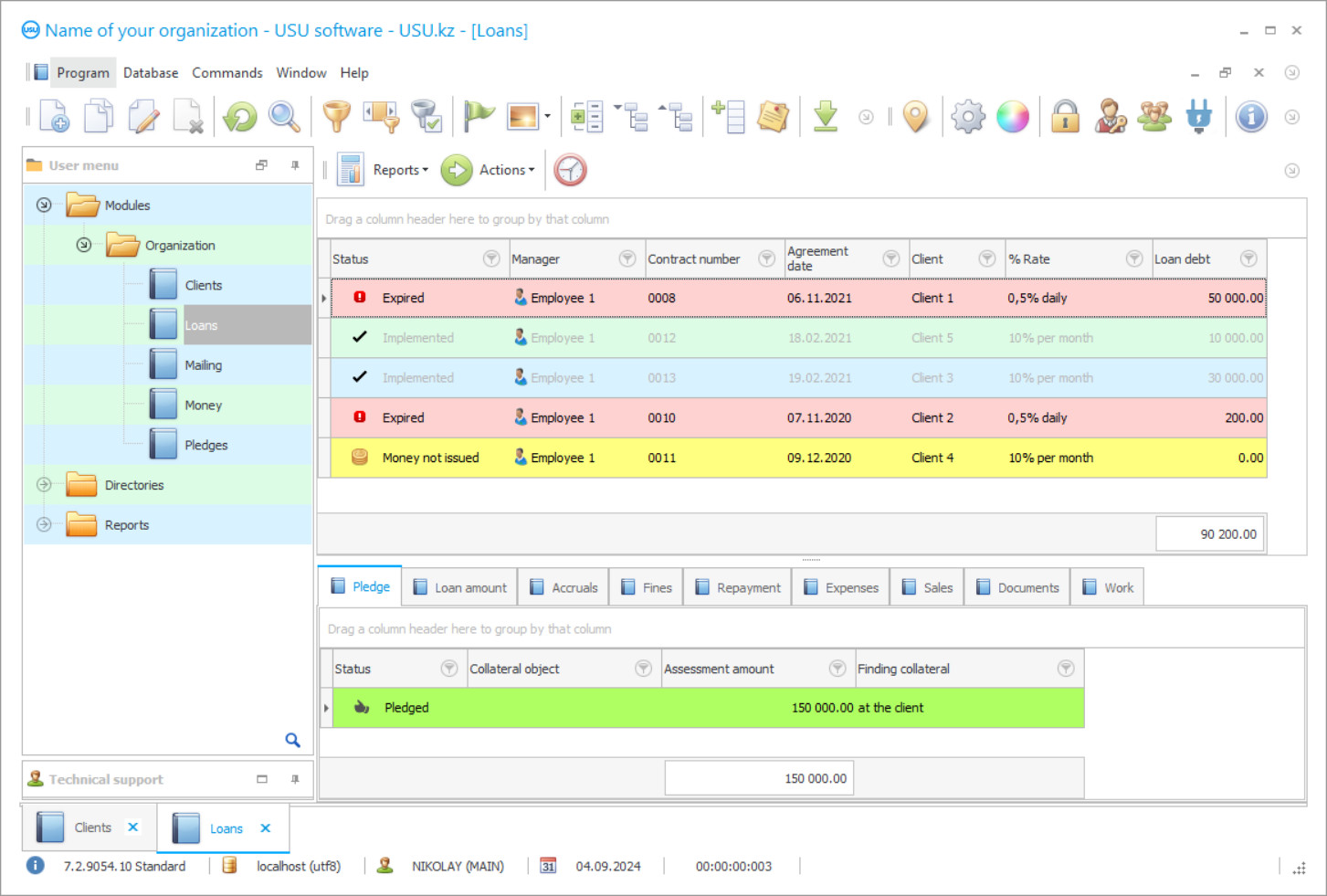

Program screenshot

Management in a financial and credit organization can also be automated, as well as accounting in it — this type of management is offered by the USU Software, which is, in fact, an automation program for organizations specializing in the provision of financial and credit services. Thanks to automated management, a financial and credit organization receive savings in various resources, such as financial resources and employees’ time, as well as a lot of other different ones, which can be used to expand credit activities or reduce staff size at the financial credit organization. Management in financial and credit organizations, like management in any other organization, is interested in increasing profits by increasing the efficiency of core activities without attracting additional expenses, just this opportunity is presented by automation of management.

An automated management system in a financial and credit organization operates with local access without an Internet connection, but if a financial credit organization has geographically remote offices or branches, then their activity will be generalized with the activities of the financial credit organization, by unifying the information into a single network and it is functioning via the Internet connection with remote control from the head office. Moreover, each financial and credit department will work autonomously, in order to form their own financial indicators, compile their own documentation, and keep reports separately from the rest, while the head enterprise will have access to the entire network — all documents, financial indicators, and reporting — the credit organization will receive an overall picture of activities, taking into account the work each remote office branch.

Who is the developer?

2024-04-19

Video of management in a financial and credit organization

This video can be viewed with subtitles in your own language.

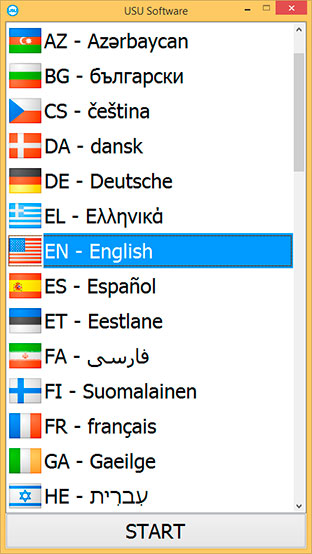

The management system in a financial and credit organization is installed by USU Software’s specialists, there is only one requirement for digital devices — they have to run on Windows operating system, the other parameters do not matter, as well as the user qualities of employees since the management program in a financial and credit organization has very simple interface and easy navigation, which makes it accessible to everyone who is admitted to the system, no matter their computer skills or experience. This quality of the system makes it possible to involve all the services of a financial and credit organization in it since for a full reflection of the work process, diverse information is required, which can be provided by employees of different profiles and levels. Special training is not required for keeping records in the system, especially since the developer offers a small training seminar to present all the functions and services, besides, only one thing is required from the staff — prompt data entry as they become available. The management system in a financial and credit organization conducts all other types of work independently.

All credit activities require a mandatory compilation of financial statements, which are submitted to the government regulator within strictly defined terms. The control system solves this problem — the built-in task scheduler gives a start to those works for which a schedule has been drawn up, and the required document is prepared by the date set for it. It is very convenient and there is no need to control the readiness of documents, at the right time they will be saved in the appropriate place. The list of scheduler tasks also includes regular backups of the organization’s information, which guarantees its safety. Time and work management is an automation function to save staff time, as this is one of its main tasks.

Download demo version

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

Document management also has a useful action function of sentence auto complete, it freely operates with all data and distributes it according to independently selected forms, according to the purpose of the document and the request. The area of its management includes accounting document flow, standard service contracts, cash orders, security tickets, acceptance certificates, etc. The finished documents fully meet all the requirements and design standards, automatic generation allows you to avoid mistakes that are often made during manual paperwork.

Our financial control system assumes differentiation of access to service information in accordance with the duties performed and the existing level of authority. This makes it possible to preserve its confidentiality and give the user a separate work in the general information space, assigning them a zone of responsibility in personal digital forms, where they place their work data generated in the course of performing tasks. The management also has access to such forms to regularly check the compliance of user information with the real state of affairs. To assist and speed up this process, there is a specialized audit function, which task is to highlight the data that has been posted in the logs since the last check. The management system marks the information of users with their logins in order to control the quality and terms of work execution.

Order a management in a financial and credit organization

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Management in a financial and credit organization

The control program automatically performs any calculation, including the calculation of wages to users, penalties in the presence of debt on a loan, profit from each loan. Calculation of piecework wages to users is made taking into account the performance of the volume of work registered in work logs, any other payment is not subject. This software requirement motivates users to quickly add their information to electronic forms, which allows the software to correctly reflect the processes. When applying for a loan, an automatic generation of a payment repayment schedule takes place, taking into account the timing and the selected interest rate, a package of according documentation.

Digital communication can be achieved using voice calls, messengers, e-mail, SMS and is often used in various advertising campaigns, for which a set of specialized templates has been prepared. If the loan has a monetary value in foreign currency, but payments are made in local money, the program automatically recalculates the payment with a change in the rate. Automatic calculations take place due to the calculation settings during the first session and the presence of a regulatory framework, where provisions for service rationing are presented. The program offers to work with unified electronic forms that have a single standard for filling out, databases that have the same structure for placing information.

Unification of work forms saves working time, allows you to quickly master the program, makes it easier for the user to move from one task to another. To personalize the workplace, users install any of the proposed more than fifty interface design options with a choice through the scroll wheel on the screen. A unique user interface allows staff to work together without any conflict of preserving information, even when recordings are made in the same document. Databases uniform in structure has a common list of items that make up their content, a tab bar with a detailed description of the content of each item. From the databases in the program, the client base in CRM format, the nomenclature, the base of loans, the base of invoices, and other documents are generated when a new application for credits or loans appears.