Operating system: Windows, Android, macOS

Group of programs: Business automation

Control of credit cooperative

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

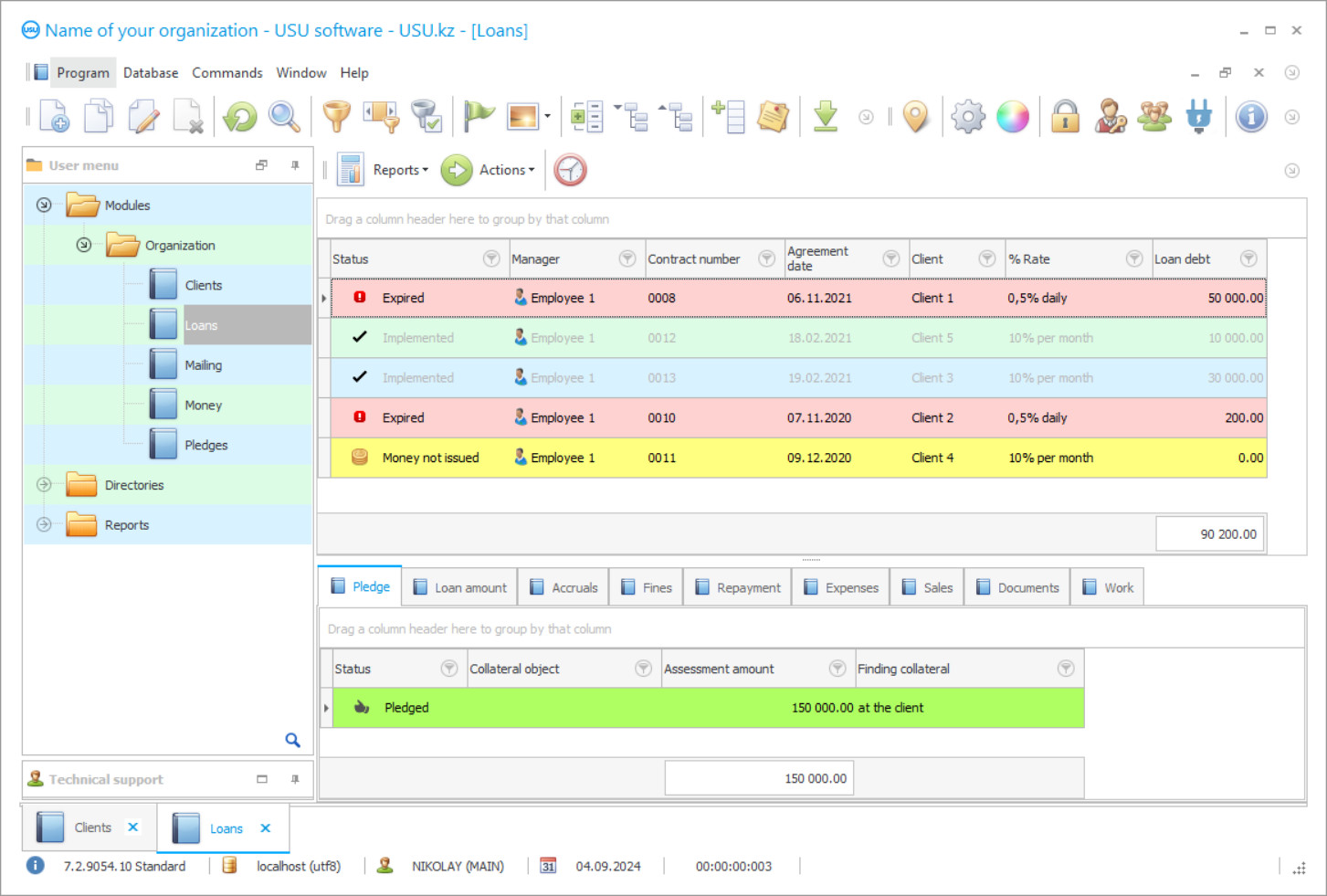

Program screenshot

In the field of microfinance organizations, automation trends are becoming more and more popular, which allows leading market players in credit cooperatives to work better with documents, build productive relationships with clients, and promptly report documentation to authorities. The digital control of the credit cooperative is based on high-quality information support, where comprehensive data sets are collected for each category. The system also maintains archives, monitors staff productivity, and solves all internal organizational issues.

On the website of the USU Software, full-fledged internal control of credit cooperatives can be established in just a few seconds, which will greatly simplify the processes of organizing business and managing the structure of credit cooperatives. The program is not difficult to learn at all. If desired, cooperative control characteristics can be tuned independently in order to work productively with the client base, track credit transactions, loans, and other types of finances, as well as prepare packages of accompanying documentation.

It is no secret that the credit cooperative control system tries to regulate the main channels of communication with the consumer. It will not be difficult for users to master the target mailing module. You can record a voice message, use popular messenger programs or regular SMS. In general, working with internal documents will become much easier. Digital control will allow you to streamline loan and pledge agreements, accounting forms and statements, security tickets, and accompanying documentation. It is not prohibited to make attachments to certain credits, including image files.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-04-24

Video of control of credit cooperative

This video can be viewed with subtitles in your own language.

Also, the credit cooperative control program takes over exchange rates and automatic calculations. If the course changes, our software will be able to quickly recalculate all the information. In the event of a delay in payment, interest and penalties are charged, and information notification is received. Each loan is monitored by the system. No internal transaction will go unnoticed. The implementation of interests calculations is displayed in a separate user interface, it is easy to balance out the balance of profits and expenses, study the schedules of financial movements, evaluate the specific contribution of personnel to certain indicators.

Don't forget about CRM systems. CRM stands for Customer Relationship Module and greatly helps with the automation of all customer-related work in the credit cooperative company. Modern automation systems have to not only regulate credit relationships and carry out automatic calculations but also work for the future, attract new customers, assess the popularity of services, etc. With regard to the internal relationship with the staff, every aspect of the management of the cooperative is also under the control of the digital system. On this basis, the key principles of the work of full-time specialists are built, which allows the rational use of work resources.

In the field of microfinance organizations and credit cooperatives, it is extremely difficult to establish full company management without automated control. Previously, cooperatives and companies with a lending direction had to use several software solutions at once, which did not always have a positive effect on management. Fortunately, the need to operate two or three programs simultaneously has disappeared. Under one cover, the main management characteristics are perfectly implemented, which allows you to bring together the levels of management, improve the quality of operational accounting and the productivity of operations, and reduce expenses.

Download demo version

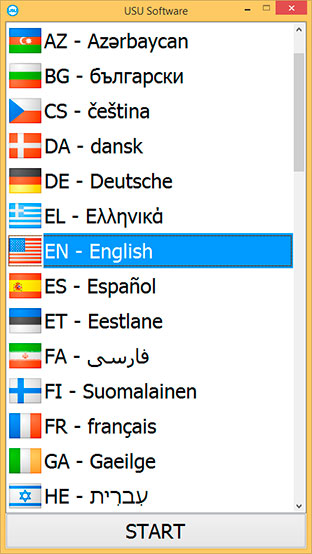

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

The software assistant monitors key aspects of managing the microfinance organization, including overseeing ongoing applications and lending operations for credit cooperatives. Credit cooperatives will be able to use the main communication channels to build productive relationships with customers. For example, targeted mailing via SMS or messengers.

All internal documents, such as loan and pledge agreements, acceptance certificates are under electronic supervision. The system will conveniently organize information by the borrower. Current orders are tracked in real-time. There is an opportunity to update the data and add pictures and images of the product. Calculation of interests, accruals, exchange rates, and a lot more are subject to the control of users. Accompanying documentation is prepared automatically.

This program will be able to raise an exhaustive volume of statistical information on any credit cooperative operations. Any cooperative will also be able to regulate the positions of the addition, repayment, and recalculation of loans. The latter is necessary for calculating the rate changes. In this case, the calculations take a few moments. Internal relationships with staff will become more productive and optimized. The productivity of full-time employees is recorded as accurately as possible. On request, it is possible to integrate with third-party equipment and, for example, connect payment terminals.

Order a control of credit cooperative

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Control of credit cooperative

Control over financial expenses is included in the basic spectrum of the program's functional characteristics. Based on these indicators, you can significantly reduce expenses. If the indicators of the credit cooperative lag behind the planned values, expenses prevail over the profits, then the software will report this. In general, managing a credit cooperative will become much easier when every step is controlled and accountable. Internal reports are highly detailed. Users do not have to spend extra effort to process, decipher and assimilate analytical data in an elementary way.

The USU Software includes changing the design to meet corporate standards, installing additional options and extensions. It is worth trying out the demo version in practice in order to get to know the program in person.