Operating system: Windows, Android, macOS

Group of programs: Business automation

Automation of credit institutions

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

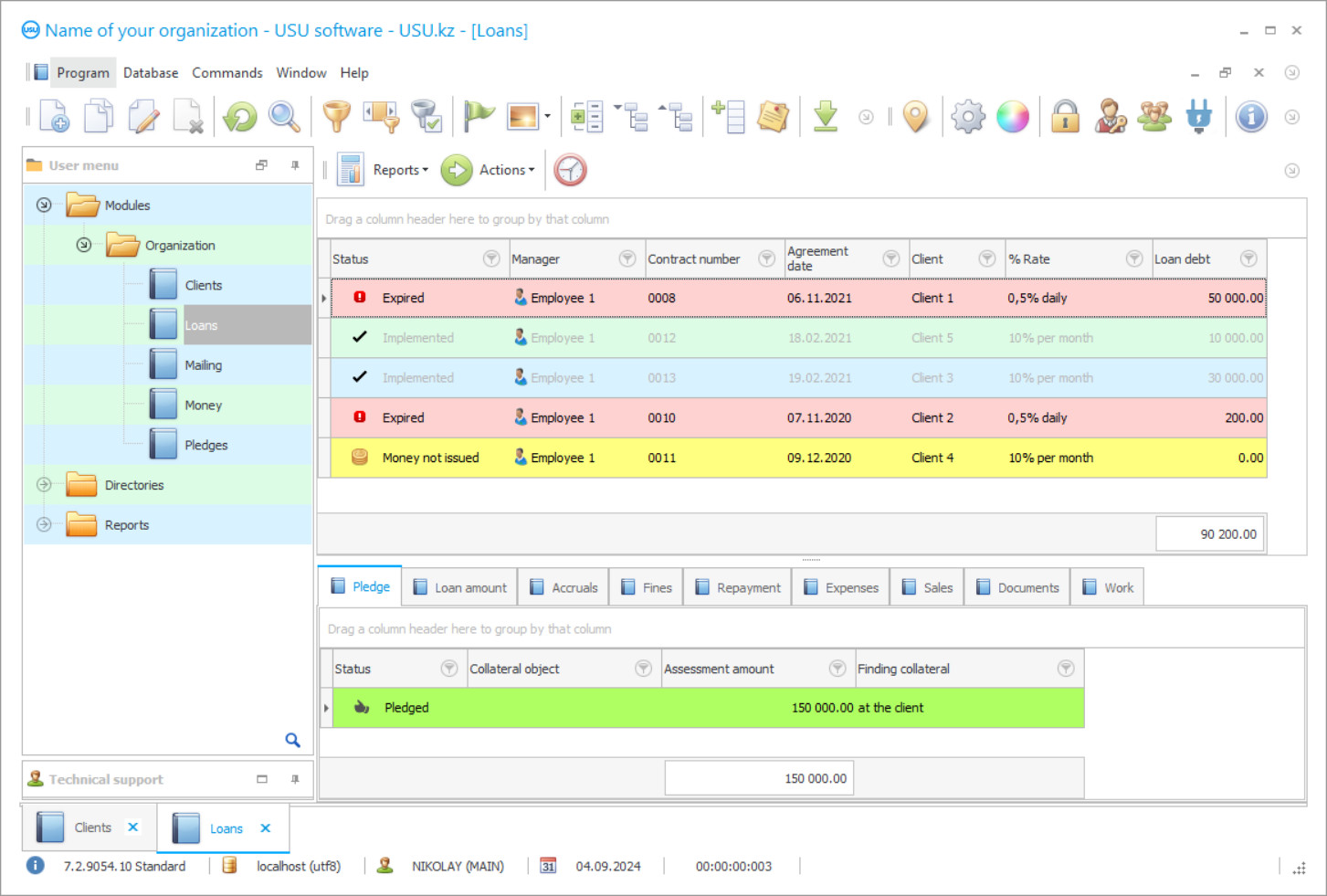

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

Program screenshot

In the microfinance business environment, automation of credit institutions is becoming more and more important when industry representatives, both small companies and leading players in the financial institutions, need to streamline their workflow and build clear mechanisms for interacting with credit clients. Also, the automation of credit institutions is beneficial with high-quality analytical support, where a gigantic amount of information is collected for each accounting process on the enterprise, such as loans, borrowers, and pledges. In addition, with automation, it is much easier to regulate the employment of regular staff.

The program for automation of the accounting of credit institutions is represented by several projects at once at the website of the USU Software development team. These projects are specially developed with an eye to the standards of the microfinance sector and the realities of everyday operation in this business segment. The USU Software is really simple to understand despite the expansive set of functions. For ordinary users, a few practice sessions will be enough to thoroughly understand the program for automation of credit institutions, evaluate all benefits of the program, learn how to work with loan documents, track current processes and operations in real-time, and a lot more.

It is no secret that automation is especially appreciated for the flawless calculations that are performed automatically. It will not be difficult for a microfinance institution to quickly calculate interest on loan agreements or split payments for a strictly designated period, prepare reports. With automation, working with operational accounting is a pleasure. Each position is clearly ordered, digital guides and catalogs are presented, documents are sorted, templates of regulatory documents are compiled. Not a single financial transaction will go unnoticed.

Who is the developer?

2024-04-20

Video of automation of credit institutions

This video can be viewed with subtitles in your own language.

Do not forget that the financial institution will gain control over the main channels of communication with clients, including e-mail, voice messages, SMS, and various digital messengers. At the same time, the credit structure will be able to choose the most preferred means of communication itself. Another task that an automation project sets itself in a selected segment is effective work with debtors. And it's not only about accounting for debts or information notifications that can be sent automatically, but also about the programmed accrual of penalties and fines.

The automation system of credit institutions performs accounting or online monitoring of the exchange rate to instantly display changes in the loan documentation. Also, the credit institution software assistant regulates the positions of financial translation, repayment, and addition. Each of these processes is displayed as extremely informative. The microfinance institution will be able to substantively work with credits, register financial assets, post images of various products, give a preliminary assessment, indicate the conditions and terms of return, collect the necessary documentation package, and a lot more.

Do not be surprised at the demand for automation in the environment of microfinance and credit institutions. Representatives of the industry need to qualitatively monitor current processes, work for the future, and have a clearly organized and structured workflow at hand. But the most important thing is programmatic work with clients. Each company will receive a wide range of tools to contact clients and debtors, attract new customers, advertise services, improve service quality and keep up with the times.

Download demo version

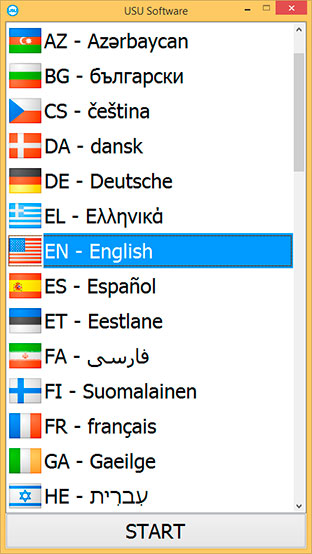

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

Programmatic support oversees key aspects of the microfinance institution's management, monitors the allocation of financial assets, and handles documentation. It is allowed to independently configure accounting parameters in order to comfortably work with digital directories and catalogs, to monitor the performance of full-time specialists. With automation, it is easier to simultaneously monitor completely different levels of management.

Preparing credit documents will stop taking huge amounts of time. Regulated templates, acts of acceptance, and transfer of credits and financial orders are prudently entered into the digital database of the USU Software. Our credit institution automation project captures the main channels of communication with clients, including e-mail, voice messages, and SMS.

For each of the current credit operations at the institution, it is possible to request a sample of analytical or statistical information. The institution won't have to work on financial calculations for a long time. The program will automatically calculate interest on loans, break payments for a certain period. Our basic range of digital support includes online monitoring or accounting of the exchange rate in order to be able to instantly display changes and indicate the updated rate in the regulatory documentation.

Order an automation of credit institutions

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Automation of credit institutions

An extended version of the program is available on request. You can connect external equipment, payment terminals, or CCTV cameras. One of the tasks of the automation system is total control over the positions of financial accounting. If the current performance of the microfinance institution deviates significantly from the plan, then our software will immediately report that. In general, working on credit agreements will become much easier when the application provides all possible assistance at every stage of the institution’s work.

The option of accounting for pledges is implemented in a special interface to make it easier to register material values, publish pictures and images, give an assessment, attach accompanying documents.

Our advanced application opens up the opportunity to radically change the program’s design, add certain options or install vital functional extensions. We also suggest checking out the program for yourself using the free demo version of the USU Software that can be found on our website.