Operating system: Windows, Android, macOS

Group of programs: Business automation

Automation for microfinance organizations

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

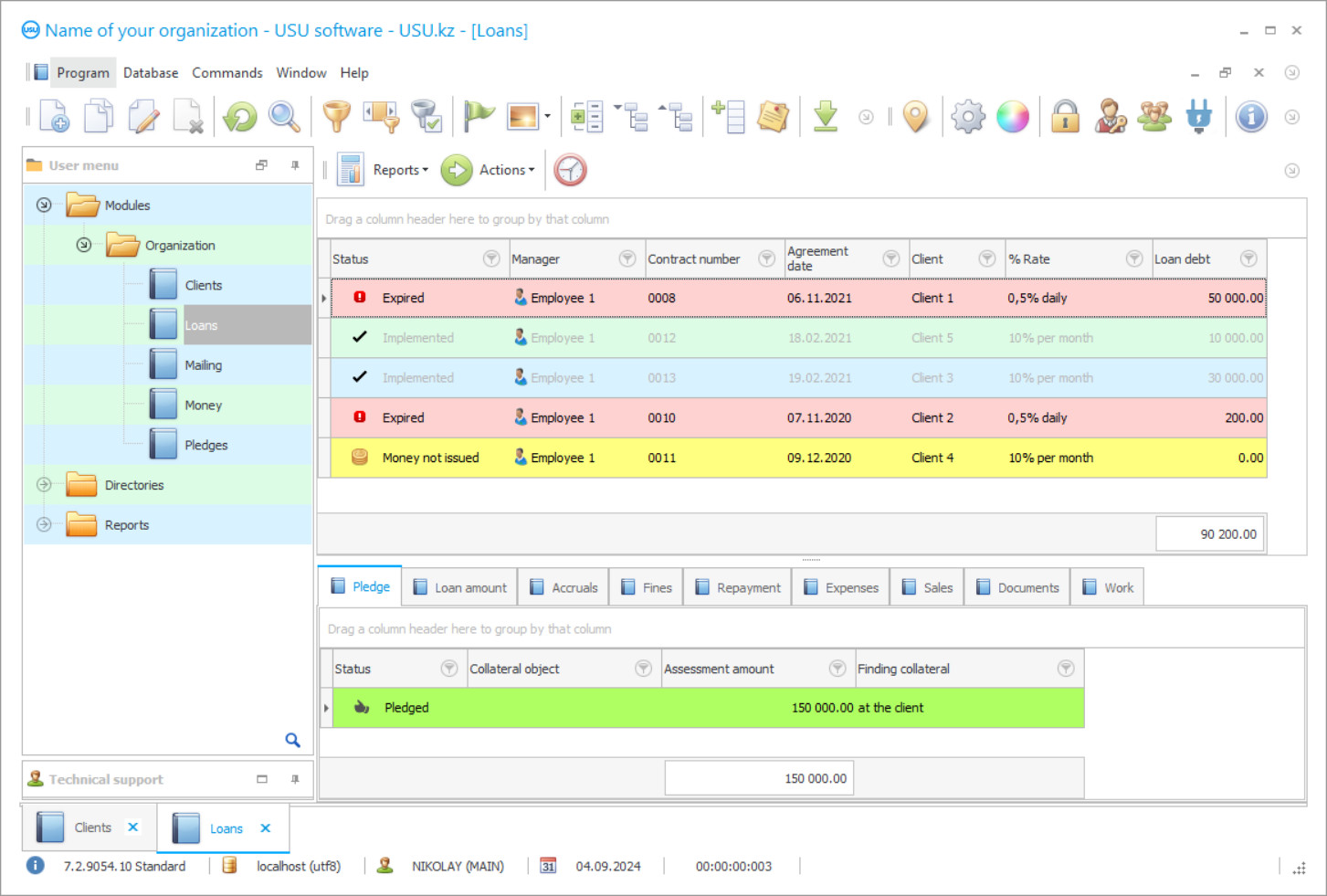

Program screenshot

Automation for microfinance organizations is required for any microfinance organization. A feature of microfinance organizations is their high labor intensity and the need for accounting, since clients who have not received a loan from a bank turn to such companies. The popularity of automation software for microfinance organizations is growing before our eyes thanks to the simplified loan process, high approval rates, and fairly reasonable interest rates. Considering customer and financial flow, few companies can boast of organized and efficient work. At the same time, do not forget about the workflow in microfinance organizations, which turns the work process into an endless routine. For this reason, under the pressure of the human factor, a manager may simply forget to contact the client in a timely manner in case of debt, interest, and penalties will increase, which will affect the organization's financial position. Regulation of activity is almost impossible to implement manually. The need for systematization of data, delineation, and regulation of the amount of work, consideration of each application for a financial loan, work with debtors, and other internal work processes cannot be physically tracked at the same time. Therefore, the introduction of automation for microfinance organizations becomes the optimal and rational solution in favor of modernizing the enterprise. Automation of microfinance organizations will significantly affect the course of its development, optimizing all processes, simplifying the implementation of tasks, and contributing to an increase in all labor and financial indicators. Absolutely all tasks for accounting, management, and even maintenance using automation programs are carried out automatically. Automation of accounting of microfinance organizations allows you to regulate all accounting transactions at each stage of the sale, from the issuance of a loan, ending with its closure. Automation of accounting in microfinance organizations gives advantages not only in the implementation of accounting operations but also in the preparation of documentation, data processing, and reporting, which is necessary for the management on a daily basis.

Various automation systems differ not only in the type of activity and specialization of processes but in the methods of automation themselves. To optimize activities and processes for accounting and management activities, it is most effective to use automation programs of an integrated method. This method provides for the intervention of human labor, but in minimal parameters, transferring tasks to the implementation automatically. Choosing a suitable program is already half of the success, so you should take this issue responsibly and study all software products on the market.

Who is the developer?

2024-04-16

Video of automation for microfinance organizations

This video can be viewed with subtitles in your own language.

The USU Software is an automation program that has in its functionality all the necessary options to optimize work activities in any organization. The USU Software is suitable for use in any enterprise, including a microfinance organization. Automation for microfinance organizations, keeping records, and implementation of management with the help of the USU Software makes it possible to complete internal work tasks as quickly as possible and concentrate on increasing the volume of sales by promptly serving clients per shift. The USU Software is implemented in a short time and has an almost individual character since software development is carried out taking into account the identification of the needs and preferences of each organization.

Automation of activities with the help of the USU Software is carried out in record time, does not require disruptions in the course of work and additional investments. Automation of the work of a microfinance organization with the USU Software will allow you to perform a number of tasks such as maintaining accounting operations, displaying data in reports for each working day in chronological order, a quick process for reviewing applications and approving loans, storing all the necessary information on the enterprise and clients, making settlements, development of payment schedules for repayment, SMS and e-mail distribution, etc.

Download demo version

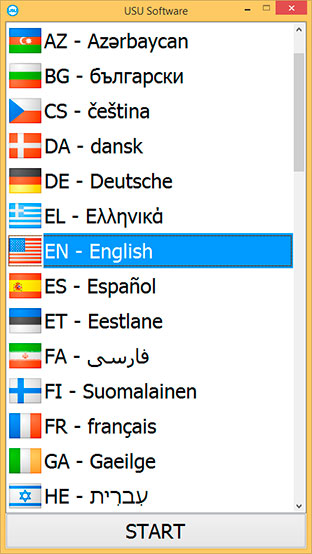

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

Our app will help with the automation of your business to achieve success and prosperity without the risk of any losses! The USU Software has a clear and easy-to-use menu, which facilitates quick training and the transition of employees to a new format of activity. The use of our app significantly affects the increase in sales due to the increased efficiency in the implementation of the work processes of the microfinance organization. Complete systematization of information provided by the function of input, processing, storage, and formation of a database with data. An increase in the speed of service for the consideration of applications for microloans and borrowings, which in total will affect the growth of sales per business day. The control of issued loans and credits is carried out in the system thanks to management functions, employees always have the necessary information, and the program can notify about the beginning of a loan delay and the formation of debt.

All calculations in the program are carried out automatically, simplifying operations for employees and guaranteeing accuracy and error in the calculation of financial interest, penalties, etc. Automated document flow allows you to avoid routine work, facilitating the process of filing applications and their documentary support. The management can easily control the workflow of all branches of the microfinance organization thanks to the remote control mode. Automation in interaction with clients is characterized by the ability to carry out SMS and e-mail distribution with various kinds of information for the client.

Order an automation for microfinance organizations

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Automation for microfinance organizations

Automation of the loan issuance process, from the consideration of the application to the closing of the contract, makes it possible to fully optimize work with clients. Accounting activities are carried out in accordance with the rules and procedures established for microfinance organizations. The ability to protect data with an additional data backup function, this function is relevant for microfinance enterprises, since the business has a financial turnover. Automation of control and management will allow the development of new and better methods of leadership in order to improve the financial performance of the organization. Microfinance organizations that already use the USU Software in their activities note a decrease in the number of debtors due to an optimized and efficient work format. Organization of work discipline and measures to increase the level of work productivity. Limiting the influence of the human error factor that can interfere with working with clients. The automation app provides unassisted analysis and audit options. The USU Software’s development team provides only a high level of service!