Operating system: Windows, Android, macOS

Group of programs: Business automation

Accounting for credit operations

- Copyright protects the unique methods of business automation that are used in our programs.

Copyright - We are a verified software publisher. This is displayed in the operating system when running our programs and demo-versions.

Verified publisher - We work with organizations around the world from small businesses to large ones. Our company is included in the international register of companies and has an electronic trust mark.

Sign of trust

Quick transition.

What do you want to do now?

If you want to get acquainted with the program, the fastest way is to first watch the full video, and then download the free demo version and work with it yourself. If necessary, request a presentation from technical support or read the instructions.

Contact us here

How to buy the program?

View a screenshot of the program

Watch a video about the program

Download demo version

Instruction manual

Compare configurations of the program

Calculate the cost of software

Calculate the cost of the cloud if you need a cloud server

Who is the developer?

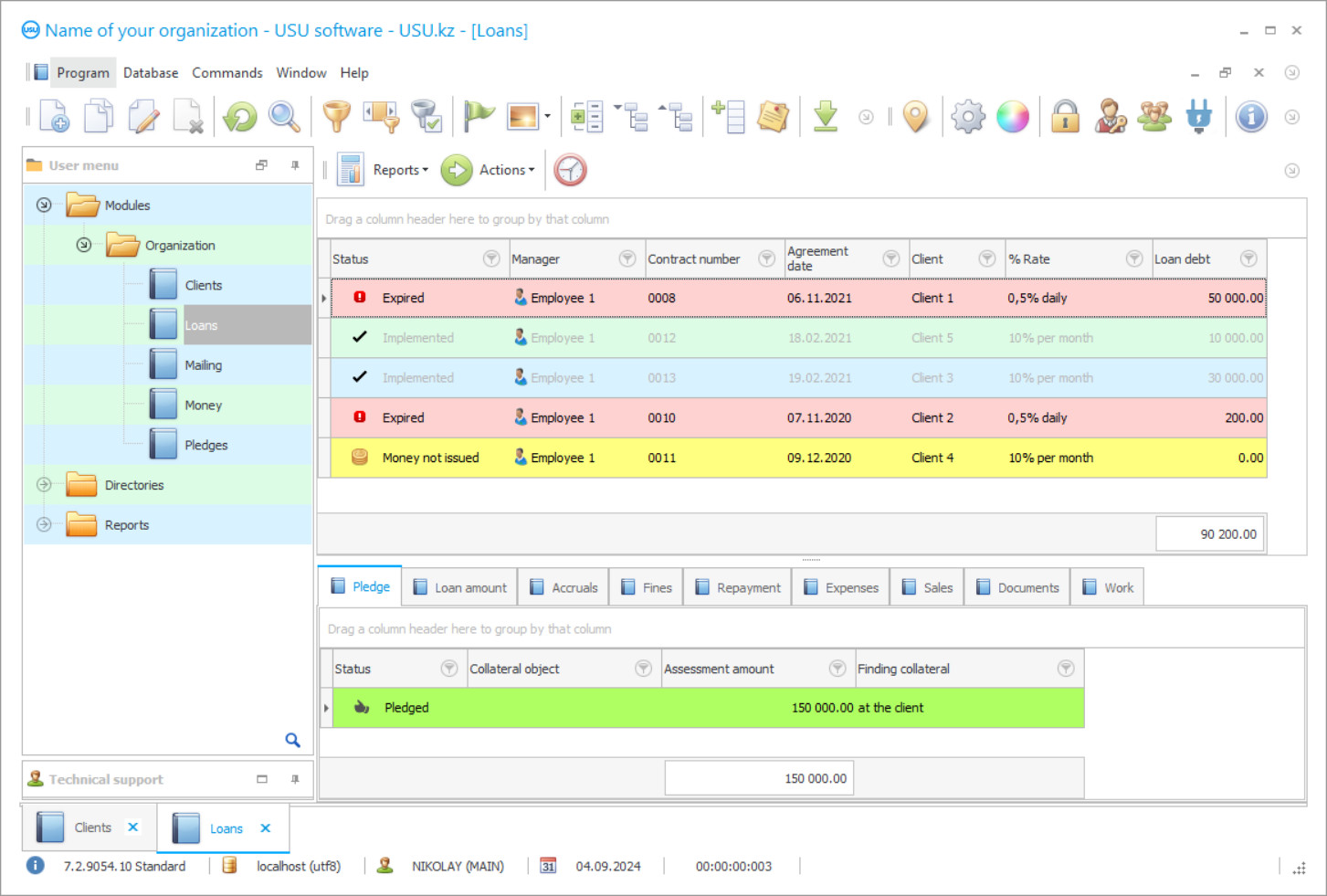

Program screenshot

Loan transactions are recorded automatically in the USU Software, which means that any loan transaction will immediately be displayed on the account and in all documents related to loans, including colour indication, which is provided in the automated accounting system to ensure visual control of all operations that take place when servicing a loan. All operations are carried out without the participation of personnel, hence the approval of ‘automatic accounting’, which makes the actual accounting not only more efficient, since the speed of any operation is a fraction of a second, regardless of the amount of data in processing, but simply effective due to the completeness of coverage data to be recorded. Moreover, with automated accounting, all calculations are also made automatically, including the calculation of interest and accrual of penalties, recalculation of payments when the current exchange rate of foreign currency changes if loans were issued in a foreign currency, and transactions on such loans are conducted in national equivalent.

Accounting of credit operations in foreign currency is carried out according to the same principles as for ordinary loans, but, as a rule, the parties agree on the legality of transactions to recalculate payments when the current exchange rate of the foreign currency in which this loan was issued changes, if the foreign currency undergoes serious fluctuations. It should be noted that credit in foreign currency, if short-term, is much more profitable than a loan in national money since in the absence of fluctuations in the exchange rate of foreign currency, operations on such loans require lower repayments than in the case of a loan under similar conditions in local money. The configuration of an accounting of credit operations automatically distributes ‘foreign’ loans by types, which are determined by the purposes of foreign currency loans, to creditors, agreements, and independently conducts all types of operations that are provided to service credits in foreign currency. Its duties include control over the correct allocation of credit resources, timely fulfilment of obligations on them, and compliance with the requirements of foreign exchange legislation.

Who is the developer?

Akulov Nikolay

Expert and chief programmer who participated in the design and development of this software.

2024-04-25

Video of accounting for credit operations

This video can be viewed with subtitles in your own language.

The configuration of an accounting of credit operations in a foreign currency will automatically consider the exchange rate difference on interest payments, the exchange rate difference on payment of the principal debt by the date of payments, according to the schedule set for them, which is also generated independently by the configuration. Control over foreign currencies, more precisely, monitoring of their current rates, the automated accounting system carries out automatically and, if they fluctuate sharply, immediately conducts operations to recalculate payments according to the new rate, informing customers about this automatically by those contacts that are presented in the database, if the software is installed in the financial institution.

Accounting of operations in foreign currencies is carried out when issuing credit funds, during subsequent repayment operations or when they are returned. To account all transactions, they are registered in electronic registers since the program maintains strict control over financial resources, drawing up special forms that list the transactions, which were performed during the reporting period with detailed details for each of them, fixing the dates, grounds, counterparties, and the number of persons responsible for the operation.

Download demo version

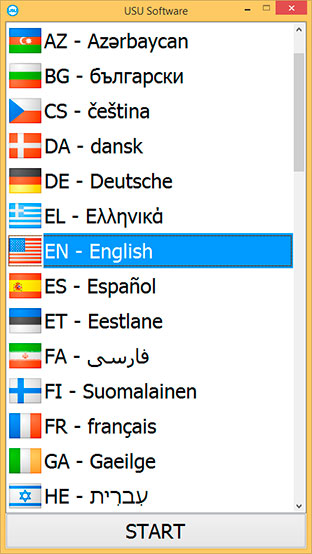

When starting the program, you can select the language.

Who is the translator?

Khoilo Roman

Chief programmer who took part in the translation of this software into different languages.

Instruction manual

Saving resources, the most important of which are time and finances, is the task of the program, therefore, it simplifies all procedures as much as possible and, thereby, speeds them up, leaving the staff with only one responsibility - data entry, primary and current. To record the information received from users, its reliability and efficiency, individual electronic journals are provided, in which the staff posts messages about their actions performed in the performance of duties. Based on this information, the automated system recalculates indicators that characterize the current state of work processes. Based on the updated indicators, management decisions are made to continue work in the same mode or to correct any process if the deviation of the actual indicator from the planned one is large enough. Therefore, the operational work of the personnel is important, which is assessed by the accounting system when calculating piecework wages to users at the end of the reporting period.

The program itself calculates a monthly remuneration of every worker, considering the quality of information posted in the work logs, so the staff is interested in the timely addition of data and their reliability. Control over the information coming from users is carried out by the management and the system itself, duplicating these functions, since they have different methods of assessment, thus complementing each other. The management checks personnel logs for compliance with the current state of the workflow, for which they use the audit function, which shows exactly what information was added to the system since the last check and, thereby, accelerates it. The credit operations accounting system maintains control over the indicators, establishing subordination between them, which excludes errors.

Order an accounting for credit operations

To buy the program, just call or write to us. Our specialists will agree with you on the appropriate software configuration, prepare a contract and an invoice for payment.

How to buy the program?

The program will be installed

If the program is purchased for 1 user, it will take no more than 1 hourBuy a ready-made program

Also you can order custom software development

If you have special software requirements, order custom development. Then you won’t have to adapt to the program, but the program will be adjusted to your business processes!

Accounting for credit operations

The accounting program of credit operations generates several databases, including a product line, a client-side CRM, a credit database, a document database, a user base, and a database of affiliates. CRM contains the history of interaction with each client from the moment of registration, including calls, meetings, e-mails, newsletter texts, documents, and photographs. The credit database contains the history of loans, including the date of issue, amounts, interest rates, repayment schedule, accrual of fines, debt formation, and credit repayment. Accounting of transactions in the credit database will not take much time as each application has a status and colour to it, so you can visually monitor its current status without opening documents. The system specifically supports colour indication of indicators and statuses in order to save users' time. The colour shows the degree of achievement of the desired result.

The accounting system of credit operations specifically supports the unification of electronic forms. They have the same filling format, the same information distribution, and management tools. The program offers a personal design of the user's workplace - more than 50 design options of the interface and can be selected by scrolling. Users have personal logins and security passwords to them, which provide personal electronic forms for work and the required amount of service information. Logins form a separate work area - a personal responsibility area, where all user data is marked with a login, which is convenient when searching for a misinformer. The multi-user interface helps to solve the problem of sharing when users conduct simultaneous work as the conflict of saving data is eliminated. The system independently generates the entire current document flow, including financial statements, mandatory for the regulator, a full package of documents to obtain a credit.

The program maintains continuous statistical records on all performance indicators, which makes it possible to conduct effective planning for the future period, to forecast the results. Based on statistical accounting, all types of activities are analysed, including an assessment of the effectiveness of personnel, client activity, and the productivity of marketing sites. Analysis of all types of activities, provided by the end of each reporting period, makes it possible to timely adjust processes, and optimize financial transactions. The program supports effective communications - internal and external, in the first case pop-up windows, in the second electronic communication - e-mail, SMS, Viber, and voice calls.